In case you are wondering how much loan amount you are entitled, this article intends to address that.

By now, you should already know that the maximum housing loan amount Pag-IBIG can possibly grant to a member is P 3,000,000 while the smallest amount is only P 100,000. And the corresponding interest rate is actually shown at the Right Panel of this website.

Basically, there are two very important factors that affect the loan amount you will be entitled to:

- The amount of your contribution

- Your Net Disposable Income

Naturally, if you want to avail of a bigger loan amount, you need to increase your contribution and demonstrate that your Net Income is also large enough to cover the monthly amortizations.

These things are easier to understand with the following Tables.

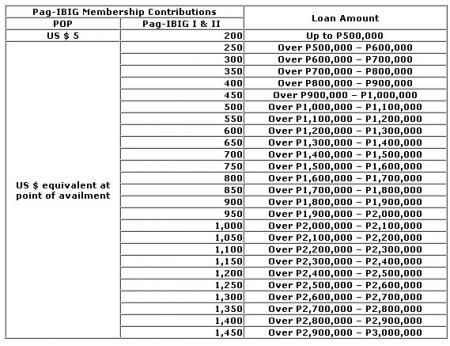

Loan Entitlement Based On Pag-IBIG Contribution

So looking at the table, if you need, for example, to get a loan amounting to P 2,000,000 your contribution should be P 950 / month. Now PhP 950 /month is easier for most Pag-IBIG Members. Quite frankly, there is no problem in that area.

Special Note to OFWs / POP Members: Since you are contributing in US Dollars, the table essentially means to need to contribute the US Dollar equivalent of that amount in Philippine Peso. As you know, there is a constant swinging of values between these two different currencies so there is also a corresponding adjustment.

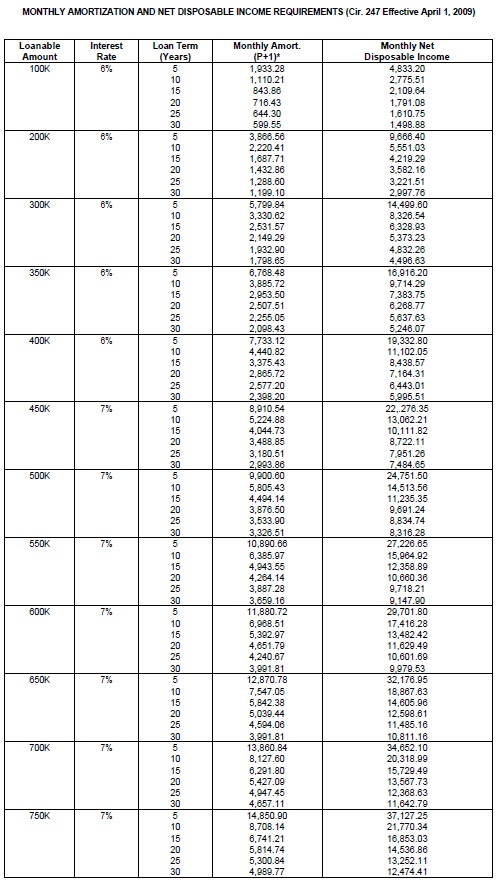

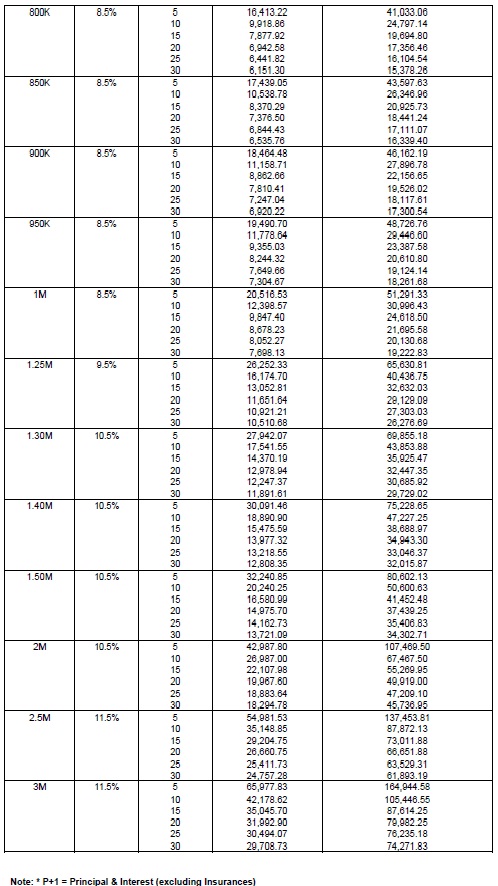

Loan Entitlement Based On The Capacity To Pay

Take note of this part and this is very important.

According to the Pag-IBIG Fund Primer on Housing Loan, “A member’s loan entitlement shall be limited to an amount for which the monthly repayment on principal and interest shall not exceed 40% of the member’s net disposable income…”

In other words, the monthly amortization should be less than 40% of your net disposable income.

The following Table should guide you.

For example, if you are looking to get a PhP 1,000,000 loan and plan to pay it in 10 years (monthly amortization is P 12, 398.57 at 8.5% interest per annum), your net disposable income should be PhP 30,996.43 or higher (the higher the better).

So to avoid having problems paying for the property, that means you have to work backwards: Determine your net disposable income first, then buy a property based on the amount of loan that you can comfortably pay.

Let’s see if you really understand the Table shown above.

Question: You are planning to get a Pag-IBIG Housing Loan amounting to P 2,000,000 and pay it in 10 years. How much should your monthly income be?

Answer: Your monthly income should be P 67,467.50 or higher. And your monthly contribution should be P 950.

Additional Notes on Borrower’s Eligibility For Housing Loan

To be eligible for the housing loan, a member should:

- Be a member for at least 24 months and has remitted at least 24 monthly contributions.

- Be 65 years old or younger at the time of loan application.

- Not be more than 70 years old at the maturity date of the loan.

- Have no outstanding housing loan from Pag-IBIG.

- Have no Multi-Purpose Loan in arrears at the time of housing loan application.

- Have no Pag-IBIG Housing Loan that was foreclosed, cancelled, bough back or subjected to dacion en pago.

Related Articles To Check:

- Pag-ibig Housing Loan Process

- Housing Loan Requirements

- Multi-Purpose Loan

- Pag-IBIG Overseas Program

- For Employees: How To Become A Pag-IBIG Fund Member

~~~

This article on Income, Contributions and Loan Entitlement is written by Carlos Velasco.

Hi Sir thanks for the INFO may I ask, I have just payed my monthly contribution and paid it for a year 400/month . i just noticed the table so I am gearing up to take a bigger loan can I upgrade my monthly contribution on the same time maybe after a month can i upgrade and take take a bigger loan for housing?

thanks

Jronquillo

Hello Admin,

Ask lang po kasi I ask my employer to increase my premium from 100 to 200 para maka avail ako ng 630k n housing loan. My employer disagree kasi daw po magiging 200 din daw po yong sa contribution nila. Di po ba yon pwede?200 sakin 100 sa employer?

Thank You!

Josh,

You are right. They are only required to contribute P 100 / mo as counterpart.

Hello Admin.

What if my net disposable income is short of 4K?Like we applied for a housing loan which is worth 900k and my net disposable income is like 15,000 only. can i just increase my monthly pag ibig contribution? or my husbands salary and mine will be combined so we can get a housing loan approval.

Wilma,

You can combine your salaries to be able to get a higher loan amount. He must be a qualified member also.

ask ko lng po f ito nga un i.d. no. q sa pag -ibig 290-000-530703nv. hindi po nabigyan ng id ang anak ko noon kc po hindi xa nkpagseminar, pero ngbayad na po sya ng membership contribution para sa akin na 4,800 philippine peso. paid last oct.30,2009. receipt#5625064. pero hindi ko na po ipinatuloy ang paghhulog ng contributions . now gusto ko na po ulit ituloy ito as of now andito me sa israel .paano po ang paghuhulog nito dito sa israel? thnx!

JosephR:

Take note that it has to go both ways: Increase your contribution and make sure your salary/income fits with the minimum required.

Wilma:

Yes you are right. You can tack-in both your salaries (make him a co-borrower) and increase your contribution at the same time.

Merlita:

You may pay at any Pag-IBIG Office or any of its affiliates. The best thing really is to issue a set of post dated checks.

I’m a Pagibig member. Presently I’m working abroad or an OWF. Based on your requirement I am entitled for Housing Loan because I have more than 24 months in contributions. The question are: If I can still avail the loan even I stopped paying the contribution 10 years ago when I started working abroad and since my contribution during that time is just PHP 200.00 it means that I’m entitled only up to 500k. Hope to hear from you soon. Thank you & Regards

ask ko lang po meron po kase ako outstanding loan amounting to Php3,972.97. eh ang huli ko pong contribution is last march 2010 nung nag-resign po ako sa previous employer ko,mag-1 yer na po un di na babayaran, may interest po ba un?and how much?at saan ko po pwede i-settle un?thank you very much and hoping for your response.

how do i know my status as a pag-ibig member and if my contributions were indeed remitted to pag-ibig by my previous employers?

Hello!!

I’d like to ask something about the exact loan possible for an employee whose net income is only 13K. I called your office yesterday, friday and asked if it was possible to loan 1.2M and payable for 30 years. The answer I was given to was of course and unexpected, NO. But then again, he told me and Pag-Ibig has this sort of “co-borrower” or something like that. I didn’t get the details clearly so it would be really nice if you guys could clarify this one to me. I really want to loan 1.2M.

Thank you and I hope you could get back to me ASAP.

Marc

ps. The person whom I spoke with on the phone suggested if I could attend the seminar. It would have been splendid if I had the luxury of time since I’m currently employed, there’s no way for me to attend the seminar, unless I decide to be absent, which I don’t want to do. Thank You

Hi! Me and my husband wants to apply for a housing loan worth P300,000.00 is it possible that m we join in our salaries so we can reach the net disposable income. What are the requiremnts for this type of loan and how many months are we going to wait before it will be approved. Thank you very much and hoping for your immediate response.

gusto ko po sana mg money loan paano po kea ???????ano ang mga requirements???at ano po ang mga kelangan gawin?????????2yrs loan p lng ho ako

RafaelToMe:

To be eligible for a loan, you have to be an active member; meaning you must be contributing at the time of loan application.

Analyn:

Please remember that any loan from Pag-IBIG (or any financial institution for that matter) bears an interest. If you are not paying your MPL loan, Pag-IBIG will simply deduct the dues from all your previous contributions.

Marc:

Thanks for your splendid question. 😉

Having a co-borrower means that you get another guy (hopefully, someone who can trust you) to co-sign a loan application so that you are not the only one borrowing. In other words, there are two borrowers: you as the principal borrower and the guy who is your co-borrower.

This is usually done so that the combined income of the two persons become large enough for them to be able to get a bigger loan amount.

Zette:

Yes, you are right. Your question is very similar to Marc. The basic requirements can be found by following this link.

sir may itatanong lang sana ako mag loan ako ng 1.3m tapos yung value ng house is 1.2 yung sobra puede ko ba ma kuha thanks

Sir ask ko lang po…my housing loan na po ako…pero gusto ko po mag-build ng small business…pwede po b ako makapag-loan ng multi purpose loan?

Hi Sir,

Pwede kung hindi kaya ng isang member yung amortization, pwede ba mag joint loan?

kunwari gusto namin kumuha ng husband ko ng worth 1M loan, pero dun lang kami sa 500K nagrange? pwede ba i join?

Melvin:

The loan amount will always be based on the appraised value and your net disposable income.

Alex:

I guess your question has already been answered on the previous article and yes that’s possible.

MJ:

Yes, you can join together and couples who are both members of the Pag-IBIG FUnd are usually doing this kind of setup.

My wife and I are both active members of PAG-IBIG, and with monthly contribution of P100 each. Our basic month salary ranges from 42,000 – 48,000. May I know if both of us can avail separately of pag-ibig housing loan? Can we avail of at least 900T each based on our monthly salary?

Apolinario:

Yes, you may apply separately. And as for the amount of loan, please take a look at the Tables presented on this article.

Hi Admin,

I applied for pag ibig housing loan. My TCP with developer is 792k and I already paid the 63k downpayment. So my balance is still 729k. HOw come my approved loan is only 720k when if we based on my income and salary monthly my max loanable is 1.2M? Please enlighten me. Thank you.

Hi Admin,

Just want to ask if my absences ,late and under time will change my monthly contribution . My company is using 2% of MC Scheme. Appreciate your quick reply.

Thanks,

Yayo:

There are factors to consider and it’s difficult give an opinion based on incomplete information. So, please ask the loan officer why that’s your case.

Denz:

Pag-IBIG Contribution is just a little amount. YOur company pay for it on fixed amount or the exact figure really is 2% and in which case your employer is right. 😉

Hi Admin.

ask ko lng po f my fiancee as co-borrower will also secure requirements just like principal borrower?

thanks

admin,

based on the table, my disposable income is at 8,316.00/month. and i like to loan my lot that is 160sqm in taytay, rizal para matayuan po ng bahay and as you’ve said that the loan amount will always be based on the appraised value and my net disposable income. how much would you think the loanable amount would be? and what is pag-ibig’s basis with regards to the appraisal value?

good day po. i resigned from work last aug. 2010 and continued to pay my contributions voluntarily until now. My question is, can i avail of the housing loan? meron po akong negosyo pero di pa po nakakuha ng business permit. ano po ang pwede kong gawin. pls. help nais ko pong magkabahay sa mababang interest lang. thanks.

P.S. my husband is employed and also a member of pag ibig fund.

Hi Admin,

I have a housing loan but when i transferred to other company, they went back on having 100pesos deduction on my P1 contribution. Should I inform them about my existing Housing loan?

Also, is there a chance that my interest rate can be adjusted to the interest rate today? My take out is 2006 and the interest rate that time is 10.5% for 650K.

Hi Admin,

Per my acct officer in pagibig. My unit was endorsed to forclosure dept. coz i wasnt able to pay for more than 1 year. is there a chance that i can still get it back? what shall i do coz i am in a difficult situation financially. the housing loan was take out 2005. i want to get it back. how? pls help.

hello admin, pwede ba akong makapag avail nag home improvement loan, kahit ang lupa namin ay sa government relocation area?

@Jose: You are right.

@Evans: Appraisal is basically just an estimate, but Pag-IBIG will have its basis on giving you the results of their appraisal.

@Ruby: I would suggest that you let your husband apply for the housing loan.

@Joey: Yes, you may want to pay for a higher contribution. Also, please let your employer be aware that you have an outstanding Housing Loan.

As for the adjustment of the interest rate, unfortunately it’s not possible.

@Ana: You may still redeem it. It’s urgent that you proceed to the Pag-IBIG Office where you got the loan.

@beverly: YOu may want to avail of the Multi-Purpose Loan and use the proceeds for the home improvement.

hi admin ask lng po ako…ofw po kasi ako and I’m paying my pag ibig contribution for almost 2 years na…yung house ang lot po kasi ng tita ko ma forforclose na ng financing company.pwede ko po ba yun bilhin gamit housing loan?thanks

@catherine: Yes, it’s possible, but it may not be easy. Please check on the documents required by Pag-IBIG from the developer of the house and make sure that you are qualified to loan from Pag-IBIG.

hello admin, bakit po ang housing loan amortization namin d2 bataan area ay masmataas P2,671.95 for 30 years at P400,000 loanable amount at sa mga nakikita naming other subdivision di hamak mas maganda at mas malaki kaysa sa developer namin dito.

good day..ask ko lang po…? bakit ganun ung sa housing loan ko..na alam ko na pinirmahan ko na sa contract eh 15 yrs sa developer but ng makita namin sa pag-ibig ay naging 25 yrs to pay..and also almost 3 yrs na kaming nagbyayad ng monthly amortisation na 6,300 pesos..nagdown payment po kami ng 20% ng price of the house n 650k as an equity…

then ng ma check namin ang balance eh 560k pa din ang bal. to pay sa pag-ibig..so ang tanong ko po eh bakit magkano po ba ang pumapatong na interes talaga annualy ( 6%? ) so total na nabayad lang namin lahat including equity and 30 months 90k lang..but we r paying monthly of 6,300 pesos =75,600 annualy..in total na naibayad namin sa 30 months eh201,600 pesos na plus ung equity ? which is na naibayd ay nappunta lang sa interes lahat lang ung naibabayd ko yearly..

ang monthly contribution ko po sa pag-ibig eh 400 pesos lang…so another question…ano po ba ang mas maganda na pagbayad pra bumaba ang balance at interest ng bahay..at ppwede po bang magdagdag ng monthly amortisation and ung pag-ibig contribution ko pra maging low cost for 10 years to pay na lang.?..thanx a lots…

@ben:

Good question. Quick answer for you.

You can check your interest rate when you request for a statement of account. Actually, on the early life of the loan, a major part of your amortization goes to paying for the interest — only a small portion goes to cover the principal. Now if you pay an amount which is more than the scheduled amortization due, the excess amount will cover the principal… This way you can save on your interest payments!

Consider this: If you pay an extra one month at the end of each year, your 30-year mortgage will be paid off in 15 years!

@virgil:

Some factors that determine your monthly amortization include: loan amount, interest rate, loan term.

memeber po me ng pag ibig ng 10 yrs.mula 1989 to 1999 pero natigil po me mag hulog ng mag abroad me.pwede po ba me mag loan?paano po?.at sabi nun sa company namin dati pag 10 yrs ka na pwede mo na wdrahin yung hinulog mo.totoo b yun?ill wait for response thank you.

gud am po. pwede po bng magbyad ng personal loan kz po ung dting agency po nmin d po bnbyaran ung loan nmin n dpat sna eh mta2poz n ung loan q ngaun june taz nung nagverify po q eh 1 yr lng po ung may hulog. pwede po bng aq n lng po maghulog. ask q lng po kng san po pwede maghulog aside po s office nyo?tnx po ang GOD BLESS PO…….

pwede po bng dlwang beses magbyad s isang buwan pra po mblis mtapoz? 162 per mos po kz knakltas skin dti nung agency q. tnx po….

I just want to ask how long would it take to process a housing loan (purchase of house and lot). Is it possible na ang husband ko ang magpa-process kasi andito ako sa abroad. Kindly provide list of requirements na kailangan kong i-prepare, at mga kailangan na documents from the owner ng house and lot. Pwede bang sa Pag-IBIG Main Office sa Makati magsa submit ng documents? Saang department pupunta?

Maraming salamat.

Hi, Admin.

I worked for a year but resigned and was unemployed for a couple of months. I got another job and has been working for another year now. Am I already qualified for a housing loan or do I need to have contributions for 24 consecutive months?

Also, is it possible to have more than 1 co-borrower?

Thanks!

@ulysses:

You need to be an active, contributing member so that you can apply for a loan.

@jennilyn:

YOu can pay it personally.

@jennilyn:

yes, it’s possible to accelerate your payment by doing that.

@Rosebeth:

It really depends on the branch where you applied for the loan. Take note that before you submit anything, you need to attend first the Loan Seminar.

@Oliver:

You need to show that you have contributed at least 24 months and be actively contributing at the time of loan application.

Pag-IBIG allows up to 3 members to tack-in their contributions and apply for a single home loan.

Tanong ko lang po, ako po ay isang OFW,Gusto ko po mag loan ng 1 million, kaso ang loanable amout ko is only 500k kasi 300 pesos lang po contribution ko. pero ang monthly salary ko is 3k dollar, ano po kaya my posibilidad ba na mkaka loan ako ng 1million?

@Boni:

You can even apply for the maximum loan amount of 3M and be approved for it. That is, looking at the salary you mentioned if it’s US Dollar. Yes, if you apply for one, you will be asked to contribute a higher amount for your membership dues.

first of all you I had to give it to you admin, you had inform us very well about the pag-ibig specially for OFW’s including myself.

I would like just to ask the following:

1.) if, upon granting the loan, do i still have to continue my monthly contributions even though I’m already paying the amortization at pag-ibig?

2.) as you said that we could avail the “LOT-ONLY” loan and the “HOUSE CONSTRUCTION” loan, so my question is could I avail this two loan at the same time? or do i need to have the lot first as a collateral? and for the “HOUSE CONSTRUCTION” loan, do I need to show the house plan first?

3.)as your reply to boni, even though I would only contribute the minimum of 5$ for 24 months as an OFW, would I be still eligible to a loan of 2M if my monthly salary can cover the “monthly net disposable income” for the 2M table?

please enlighten me. I had this on my mind for a long time now and thank you very much for your time… ^_^

Hi Admin,

ask ko lang kung applicable ba ang pagibig loan sa mga condo sa metro manila? Kasi im interested to purchase a condo instead of renting a condo.

And kailangan ko bang iconsolidate lahat ng contribtion ko sa Pagibig in case nagpalipat lipat ako ng company for the last 3 years ng career ko?

What do u mean by 24 months monthly contribution? does it mean kailangan tuloy tuloy na 24 months na walang putol ka nag contribute sa Pagibig? what if kung within 2 years or 24 months e naputol o hindi ka nakapagcontribute lets say mga 3 months lang? are your stil qualified?

Thanks in advance for your immediate reply.

Marvin 🙂

magkano po ba inaabot ang insurance ng bahay na binili thru developer?

Hi admin,

pahabol pa lang tanong, what if kung for the past 24 months contribution ko eh 200 lang as the minimum nadedect sa akin per pay evry month, what if i decided to increase it to 950 or lets say 1,450. Kung itataas ko ang contribution ko kelan ako magquaqualify ng ganung loan amount from 2-3M after increasing my contribution?

Thanks again,

Marvin 🙂

Hi Admin,

How can i apply to your housing loan if I have an existing Multi- Purpose Loan?

Is it ok to pay it in full instead to apply for the housing loan?

Please advise.

More Power!

Shirley B.

Hello po, ask ko lang po kung, pwede ba ako mag-pa member sa pag-ibig, even yung husband ko is currently unmployed but his receiving money from the government dito po sa U.S and I am still working po. If pwede po siya? Is their anyway to get a loan if I will fully paid the 24 months contribution sa pag-ibig?

Sana po makasagot kaayo sa tanong. Salamat nang marami!

Take care,

Adelyn

mam / sir

i wanna know if i’m already qualified for another housing loan, because my first housing loan was already assume by mr. armando mangalindan. but everytime i file my msvs there is always a remarks that i still have an existing loan ” which is not thru because i already have all the supporting documents for my 0 balance. can you check it again for me, and please give me an update. thank you very much.

jonathan

Good day!

Inquiry lang po. Yong bahay po namin kailangan ng major rennovation. Pwede po ba ako mag apply ng pag-ibig loan – ako ang magbabayad pero ang owner (sa titulo) ang ang parents ko? Pagibig Member po ako at OFW. Thanks. Karen

First of I was wondering if I can get a loan even I’m not yet a member.I would like to purchase a house for my parents.

What should I do in order to become a Pag ibig member. I am a Canadian resident at may fulltime job po ako.

Thanks in advance for your immediate reply.

Winnie

tanong ko lang po, kc may bahay na binibinta sa akin, ngayon 1.4 yong price nya. magkano po kaya ang monthly payment ko sa pagibig?. at paano ko kukunin yong pag ibig # kc hangang ngayong wala pa.at almost 4 years napo akong naghuhulog.at katataas ko lang ng hulog ko ngayong month of aprail pwedi naba kaya akong mag loan sa 1.4? (salamat po.)

hi admin isa po akong ofw member ako ng pag ibig may benibinta pong bahay at gusto kung bilhin kaso wla p po akong ganong halaga 2.5mpeso p at ang montly salary ko ay $600 lang po qualifyied po ba ako mag loan ng ganong halaga

Hi Admin,

I have been 5 years with my company and earning about 38k per month. I confirmed with our HR that our contribution is only 100Php and seeing the bracket, is there a chance of getting a million or 2 pag-ibig housing loan if I decide to avail my own home? Thanks for the feedback!

Hi po,

Just want to ask how to activate my pag-ibig membership at malaman yong contribution ko from my Previous company in Manila. it was 4 year ago na pong di ko naasikaso yong Membership fee ko.. and almost 6 year din po akong nakapaga hulog sa Pag-Ibig. Ano po ba dapat ko gawin para ma activate at mapagpatuloy as OFW?

Thank u po

Hi,

Just want to inquire re lan amount based on the contributions made. For instance, I have been working for a little less than 5 years already and based on the summary of contributions I got from your office, my monthly contri is 100 and my employer’s also 100. Does this mean that the max loan amount i can borrow is only P500K? What if I’d like to loan 1M? And based on the table above, my disposable net income is qualified to loan the 1M, do I still have to contribute 500 for another 24mos? Or can I just increase my contri once my loan has been approved?

Thank you very much and looking forward to your reply.

Hi,

I’m currently working abroad. I want to avail a housing loan, pra mapatayuan ko n ng bahay ung lupa n nabili ko na. since gusto ko po i-avail as much as possible ung mataas n loanable amount pwede po bang ang gwin kong co-borrower e ung tita ko. Ung asawa ko po kse presently is not working.

thanks!

We would like to increase our monthly contributions, my question is that regardless of salary as long as it is 2% share of employee and employee? Example what if one of our officers earns 100,000/month this means that EE’s & ER’s share would be 2000 respectively right? Will this be okay? Because as I looked into tables of loanable amounts the maximum is 3M, which shows 1450 shared contributions. Thanks in advance for the immediate response.

Hi! Gusto ko magloan ng P1M sa Pag-ibig using my TCT as collateral kasi gusto ko magpagawa ng apartment. My monthly contribution to Pagibig is P333.74 only. Can I use my daughter as co-maker who is an Overseas Worker in Dubai? Pls advise ASAP.

Thanks.

@Leonisa:

If she’s also a member of the Pag-IBIG Fund, yes you can join and apply for a single loan.

@cez:

Actually, Pag-IBIG sets a limit of P5,000 maximum salary as the basis of employee-employer share. So 2% of that is 100. This is done for simplicity. But once you apply for a bigger loan amount,

you will be asked to contribute a bigger amount. You will find this out by the time you submit your housing loan application.

@JP:

I believe I have answered this question in the past. But in case you missed it, the short answer is “No”.

@mahmoy25:

Yes you are correct in saying that you can contribute a higher amount once you are already pre-qualified for a bigger loan amount. In other words, you will be

asked to upgrade your contributions.

@MJIbarreta:

Please proceed to the Pag-IBIG Office and ask them to give you a list of your past contributions. To re-activate, you simply contribute anew.

@Jan:

Yes, you will be asked to upgrade your contribution to a much higher amount based on the table that you saw.

@chris:

Please review this article.

@Arnold:

Please check your past payments at the Pag-IBIG Office.

@winnie:

Sorry, but Pag-IBIG Loans are only for the members of the Pag-IBIG Fund and only for Filipino Citizens.

@Lhei:

Yes its possible. But please attend the loan counselling session to see how to go about the whole process.

@jonathan:

SOrry, but you are not allowede anymore to get another housing loan.

@adelyn:

Yes. Of course you need to be pre-qualified before your loan will be granted.

@shirley:

Actually you can apply for a housing loan but you will be ask to pay the MPL Loan first.

@marvin:

Yes, it’s possible to use Housing Loan for a condo.

Please read the replies on the line @mhomay25 and @jan.

@Let:

Please check it with your developer.

@Paul:

1. Yes

2. Yes and you have to present the house plan for the house construction.

3. Yes

Very informative and very helpful. All I need to know about Pag-ibig under one site.

Thanks

hi admin…ask ko lang po kung 17000 yung salary ko hindi pa po doon deducted all the taxes pasok po ba ako sa 15yrs. if loanable amount is 750k? and isa pa pong question pano po kung one year pa lang akong member sa pag-ibig pede ko po bang i-lumpsum yung another 1 year for me to be eligible at the time of my loan application?

@izzy:

Based on the table, you are eligible for that loan amount. But, you may have to wait that you reach 24 monthly contributions. I would recommend that you attend a loan counseling session.

thank you admin..that is means po ba na hindi po pwedeng on my 13th month of my monthly contribution hindi pwedeng i-lumpsum ung another 1 year para maging 24 month agad yung contribution ko? one thing pa admin pano po ba ang computation ng net disposable income?thank you so much

Hi admin, question lang po gusto ko po sana maghousing loan kaya lang base from the pag-ibig table,if i want to loan 1.8-2M di sia kaya. i mean, ang monthly contribution ko si Php100 lang kahit na ang monthly gross income ko is nasa Php26,0000…May iba pa ba way para makapgloan ako ng ganung halaga? May nakita na kasi ako na sa palagay ko naman e kaya ko sia bayaran kaya lang ano po ba dapat gawin..do i need to increase my monthly contribution from Php100-1,000? if that is the case, ilang months pa bago ako maapprove for 2M loan? Since 2003 pa po ako member ng Pag-ibig.and since then, continious naman po ang contribution ko. Kindly enlighten me. Thanks so much in advance.

good day admin. question po.. kc ang wife ko may MPL Loan nung may work pa sya at continous nmn ang bayad unfortunately nagresign na sia at nastop na ang payment, magkakainteres ba ung loan or babawas na lang dun sa contribution nia for the past 4 years? and if ever magsimula siang maghulog ulit sa pagibig babayran na nia loan nia?. Tanx and please advise.

@Joey:

The rule of Pag-IBIG says that any missed payments from the MPL will be deducted from the TAV (basically the total contributions plus dividends).

@sagikoi:

When you apply for that much loan, the loan officer will assess your capacity to pay, among other things, and he might require you to upgrade your contributions once you qualify for that amount of loan.

@izzy:

You need to understand that Pag-IBIG will also consider your length of employment. The Net Income is the Gross Income less deductions and it shows in your payslip.

good aftie pwede ko n po bng byrn one time ung multi-purpose loan ko?less than 1000 nlng po kc ung remaining bal. & 3mos kong ndi nbyrn un kc ngresign ako fr.my previous job.

Good day!

Tanong ko lang po kung pwede kami mag joint account ng sister ko kasi mababa na net pay nya dahil sa kaltas sa kanya. Bale sya po ang kukuha ng bahay sa pagibig sa katunayan po e tapos na po kami sa equity namin. Parehas pa po kami single. at member din po ako ng PAGIBIG matagal na.

Nung una po kami mag pass ng requirements e mataas pa po ang net pay nya…e after po mag bayad ng equity mag rerepass po kami ng mga requirements yun nga po medyo mababa na po net pay nya ngayon dahil nga po sa kaltas.

Maraming salamat po sana masagot ang katanungan.

Kind regards,

Katherine Esparas

hi admin! im planning to loan 300K kc dun po pumapasok ung net income ko..kaya lang po ngayon lang po ako mahuhulog sa pag-ibig kasi new member lang po ako..my 1st query is, pwede ko po ba i-avail un as a multi-purpose loan?2nd,possible po ba na bayaran ko na po in advance ung 2years, if yes makakapagloan na po ba ako agad? if no, gano katagal pa bago ako maaprove na makapagloan ng ganong halaga?thanku very much..i have so much queries in my mind please help!

tanong ko lang po kung pa’no mag-upgrade ng contribution sa pag-ibig? may balak po kami mag-housing loan ng 2M, when i checked my husband’s monthly contribution P100 lang. kelangan po ba nya magpunta sa pag-ibig office ng direct or puwede na po na i-request ng husband ko sa office nila na magpapa-upgrade siya? magkano po ang kelangan na monthly contribution para siguradong ma-approve yung 2M? kung P100 lang ang monthly contribution, usually magkano lang po ang naaapprove? thank you!

@jeng:

You will be adviced when to upgrade your contribution after you have been assessed for housing loan qualification.

@ams:

Please take your time. YOu are still a new member and Pag-IBIG requires that you contribute at least 24 months before applying for a home loan.

Take note also that the amount of MPL Loan is not really that much if you are a new member.

@Katherine:

Yes you can both combine your accounts and apply for that loan.

okay, your site is really useful and very informative but it was not mentioned how can we increase our monthly contribution so we can loan the amount that we exactly need.

i am an employee and the monthly PAGIBIG fee they deduct is only 200. how can i request to increase this limit so I can request a loanable amount of 2M? that is 1000 per month?

thanks in advance!

gud am po! ask ko lang po,new member po ako sa pag ibig,24 months na po yung contributions ko,OFW po ako….magkano po ba ba ang pede ko ma avail sa constuction of house loan po….may nabili po kc ako 100sqm.lot sa province…makakapag avail po ako?19 years na po ako OFW at ang salary ko po ay $900 dollars per month.

mejo mababa po ung salary ko, paro pasok po ko for 900000 loan kaso nga lang for 30 years, what if magdoble po ako ng bayad monthly kac may katulong naman po ako sa mga expenses. pwede po ba un?? para umikli ung payment term?

normaslly ganung katagal ba bago maapprove ung housing loan??

I want to avail a housing loan of P1M (Purchase of lot and construction of house) payable in 25yrs , But my salary is only P18k, my net is P14k. Based on Pagibig table, Monthly Amortization and Net Disposable Income Requirements, I am entitled only for a P750k loan for a net salary of P14k. Are there ways on how I could reach P1M housing loan entitlement? I heard of this “co-borrower”? What are the requirements that a co-borrower should be? I have a friend willing to be my co-borrower but is not a Pagibig member. Is your policy allowed him to be my co-borrower even if he’s not a member of Pagibig?

Another question: Does my monthly contribution in Pagibig affects my loanable amount? My employer has deducting my salary P100 as my monthly contribution. Does my monthly contribution should take certain percentage of my salary? I mean, how would you measure the Pagibig contribution of an employee? Is it 2% of his salary? I’m not really sure if I need to request that my contribution be upgraded so as to increase my loanable amount in Pagibig?

I really need your response. Thank you very much.

@Vhangie:

One of the ways is, as you mentioned, getting a co-borrower. But you can’t just have anyone act as your co-borrower. He/She has to be related to you, such as a sibling or parent.

As to your contribution, that’s not a problem at this point. You will

be asked to upgrade it once your income qualifies you to get that much loan amount.

@amnanrey:

I’m not sure what you mean by “doble po ako ng bayad”.

@neth:

Please read again the article to know how much loan amount you can possibly get.

@sabon:

YOu will be asked to upgrade your contributions once you qualify on a specific loan amount based on your capacity to pay, that means your income.

doble ng bayad, for example kung ang loan ko ay 800k for 30 years xa is 6151, what if lumaki po ung income ko at maafford ko na magbayad ng doble (12300php). pwede po ba un? para umikli ung paymnt term

@amnanrey:

Yes that absolutely encouraged. That way, you can also save on the interest payments.

ahhh ok po…thanx, you’ve been very helpful. MORE POWER!

very informative tong site na’to at bilis sumagot ni admin 🙂 bale eto mga tanong ko. thank you!

1. pag-ibig members kaming mag-asawa pwede bang isang application na lang ng housing loan? at dapat ba dalawa kaming aatend ng seminar?

2. paano po kung yung buong lote eh wala sa pangalan ko? nasa tatay ko, tito at tita ko. gagawin kasing apartment at ako na bahala sa financing.

3. pagka-release ng loan eh start na ba ng bayad? o pwedeng after 1 or 2 months pa?

paano po ba i-compute kung me sobra pa sa na loan ko sa pagibig compare dun sa presyo ng house sa developer. Ganito po, yung naloan namin sa pagibig ay 594000, then yung house ay 655000, yung equity namin na nabayaran ay 98000.

Loan amount=594000

Equity=98000

House price=655000

Tapos nung magpacompute kmi exceed lang kami ng 16000 na dapat sana 37000 kung di ako nagkakamali.

pno po kaya nila nacocompute yun, and pano ko malalaman na walaang hidden charges.

i availed a housing loan amounting to 600k(php)last feb. 2007. The interest rate is 10.5%. June on the same year, i learned the the interest rate for housing loan decreased to 7%.Am I not entitled to that decrease in the interest rate?

@bedol:

1. Yes, you both can tack-in your accounts under one loan. Yes you should both attend the seminar. Para sweet. 😉

2. That’s complicated. Pag-IBIG will not grant you a loan on a complicated title. The title should be in your name.

3. One month after the release, that’s the time you start paying your monthly amortization.

@marlon04:

Good question. You probably used the Loan Calculator presented here. Please take note that using the calculator serves only as your guide. It doesn’t factor in the contributions, insurance and others. Please have them explain your amortization also for further clarifications.

@philina:

Unfortunately, Pag-IBIG doesn’t allow that.

ask ko lang po..pano ko po mlalaman pag ibig number ko?…tnx and godbless po..

Hi Admin,

🙂

Tanong ko lang po kung mas mganda po ba kung ang kukuha ng housing loan, ay Married kesa single. IF married mas malake ba ang loanable?

If YES, pano if single(not yet married) nag housing loan, then biglang nag asawa after a month? Pano yung change status? saka yung loanable, ma update po ba yun agad? or pede ko sya gawin co-borrower ko. or in advance married status agad 🙂

@Maron:

If you can afford to pay a loan while you are still single, then go for it! Being married has the advantage of being qualified for a bigger loan amount, especially if the couple are both members of the Pag-IBIG Fund.

Regarding your question about getting him as co-borrower, you can’t do that while you are still on the bf-gf stage. 😉

@ralph:

Please check the latest article we have posted to get the answer to that question and more. Here’s the link:

https://www.pagibigfinancing.com/articles/2011/pag-ibig-fund-membership-question-and-answer/

Thank you so much for your prompt reply. By the way, I wish to ask another question. I’m planning to purchase a Lot (only) from a developer, to be financed by Pagibig. I have visited the site and selected a lot. But the developer told me that Pagibig do not approve or do not finance purchase of Lot only, should be house and lot. Is this really true? Why?

Tnx Admin…

another question: Plan namen for housing loan kapag married na, can both or 1 of us still be qualify to loan again like multi purpose loan?

Hello admin,

What if interesado po ako na bumili ng property na kung saan yung bahay at lupa ay under ng mga awarded properties ng government worth 300k above, tapos ang namamahala dito ay NHA (National Housing Authority. Possible po ba na ma-iapply ko ito under ng Pag-ibig, wala pa po siyang titulo, certificate of being awarded lang sa may-ari, yung titulo po kasi makukuha lang cya kapag tapos mo ng hulugan yung bahay. Yung nagbebenta po kasi ay mismong may-ari ng bahay. Please help me on this. Thanks very much.

Good day! Sir ask ko lang po kung updated yung table natin for the the monthly amortization and net disposable income requirements? Kasi po i am currently applying for housing loan with VANHOCK Corp. and the total cost of house and lot is 400k. i submitted my payslip reflecting my net income P 6,700.00. Sabi po ng vanhock kaylangan daw po atleast 7,000 yung net monthly income. Please advise po. Thank you very much.

Hi admin,

I have a question,regarding any loan.. for married couple, pano ang deduction? thru salary deduction for both? equally deducted? or depend for who has the highest salary?

in your post NO. 33

@ben:

Good question. Quick answer for you.

You can check your interest rate when you request for a statement of account. Actually, on the early life of the loan, a major part of your amortization goes to paying for the interest — only a small portion goes to cover the principal. Now if you pay an amount which is more than the scheduled amortization due, the excess amount will cover the principal… This way you can save on your interest payments!

Consider this: If you pay an extra one month at the end of each year, your 30-year mortgage will be paid off in 15 years!

kindly explain further about this?

Consider this: If you pay an extra one month at the end of each year, your 30-year mortgage will be paid off in 15 years!

is this true? how?

@Vhangie:

I’m not sure what the case for that particular developer, but Pag-IBIG definitely accepts a housing loan to be used in purchasing a lot-only. However, there are cases, especially with Pag-IBIG accredited projects that you have to buy a house-and-lot first and get an additional lot-only property, which is adjacent to the house-and-lot.

@Mar:

Yes. The MPL Loan is a separate loan altogether.

@Hermionne:

I forgot the name, but there is another goverment agency that handles that kind of project. It’s the the scope of Pag-IBIG already.

@Jocelyn:

Yes that’s the updated one.

@Mel:

That’s to the account of the principal borrower.

@Jeff:

I wish I can explain it in details here, but it would take a lot of words.

i would like to clarify if the loan entitlement would be based on the monthly contribution AND capacity to pay? i mean would it be based on that two factors and not on one factor alone? in my case, i’m planning to apply for a housing loan in the amount of more or less 750k payable in 30yrs. my monthly pagibig contribution is only 200/mo. and my monthly net income amounts to more or less 15k. if based on my monthly contribution, i may be entitled to loan of up to 500k only, but based on my capacity to pay, i may apply for the 750k loan because my net income meets the minimum income requirement. your feedback is highly appreciated. thanks! i would also like to commend the creator of this site! very useful indeed! 🙂

@iambitz:

I highly appreciate your question. I’d like to clarify this thing once and for all. Since everyone really starts at 200 / mo contribution that would indeed pose a problem if that would be the first consideration when applying for a housing loan. But, the evaluation is actually done in reverse: First, you will be assessed based on your capacity to pay. If you qualify for a certain loan amount and then you are currently contributing at the regular rate of P 200 / mo contribution, Pag-IBIG will require you to “upgrade” your contribution based on the table. The keyword here is “upgrade”.

I hope this helps to further clarify the point of this article. Good luck!

okay, but will they process my loan application now even if i haven’t upgraded my contribution yet? or should i upgrade my contribution first before i may avail of the 750k loan? thanks so much for your time and response! 🙂

@iambitz:

Yes, they will process it, or to be more precise, they will begin the evaluation process. They will be asking you to upgrade later once your loan is approved.

Where i can search / check whether the developer is authorize / accredited by PAG – IBIG. We are now starting to pay for the equity worried lang kami baka hindi accredited ng pag-ibig yung developer. Thanks

@Jun:

You can check this by going to the Pag-IBIG Branch that handles that region.

Hallo Sir Admin,

ako po ay isang pag-ibig member since 2007..after my contract po sa company na pinagtrabhuan ko, ay nhinto kuna po ang contribution. 3 yrs napo hindi nhulugan. Andito po ako ngayon sa Germany,im married. Ngayon balak ko pong i active ulit ang pag-ibig ko. Balak po namin ng asawa ko na bayaran ang kulang at maghulog buwan-buwan. Ngayon tanong ko po, my balak palang po akong mgtrabho,hindi namadalian ang trabaho dahil may anak po kami,maliit palang. Ang husband ko ang syng tutulong sa akin para mhulugan ko po parati ang pag-ibig ko…Ngayon po,itanong kulang. Malaki ba ang posibilidad, pra mkaavail po ko sa atin, khit ang asawa ko po ang mgbayad. Kng posible man po, kasi kng mbayaran k lhat ng kulng ko sa pag-ibig within 4 yrs.. pwd po ba akng mka avail ng madalian for loan housing?..kasi yung mama ko ngrent lang ng bahay..sayang po ksi yung binabayad everymnth. Kng possible man po…ano po ba ang mging req. to avail a house?

Hanggang dito muna po at umaasa sa inyong mdaliang information.

MARAMING SALAMAT PO AND MORE POWER!

Lorna Himmel

Hi Admin,

Good day! I want to loan a lot and construction of hous at the same time specifically what this link tells: http://www.pagibigfund.gov.ph/DLForms/Checklist%20of%20Requirements/FLH050-6%20COR%20_W3_.pdf .

Q1: Are the documents in SECTION I. items 10 – 12, Addtional Requirements items 2 -4 and the most of items in SECTION II, will come from the seller? Ex. Sta. Lucia Realty. Will they be more than willing to provide those documents without any assurance yet that the loan will be granted? Same as through with a private seller who asks for cash payment.

Q2: In my understanding, does it mean that the Title should already be under my name? How can this be when we’re still on the application process? I don’t think any seller will transfer title without assurance.

Q3: If in case I got approved, will Pag-ibig release the whole amount of the appraise value of the property I am planning to acquire? Will they release the construction of house at the same time?

Q4: If in case the loan got approved, can I already start the construction of house?

Sorry for my questions if it might sound dumb but I really want to understand as I’m not knowledgeable enough when it comes to mortgage.

Hi admin!

Yung co borrower po ba sa loan kailangan na relative? Hindi po ba pwede ang fiance?

Hi Admin,

Additional question po. If for example, the land I want to acquire through Pag-ibig is owned by my relative, is still required to have an equity? What if for example, it is being sold for 1 Million, and my loanable amount is 750K, the equity would be 250K, right? Given that the seller is a relative, they won’t require us to pay the 250K since part of the land or the cash amount when it’s sold will be shared to us anyway? If not, please advise what’s the best thing to do? Thank you.

@Yzac:

You have some good questions here. Thanks for asking.

1. If the seller is asking for cash payment, that usually means they don’t want you to use a loan to finance your purchase of the property. Usually, they do this so that they will not be involved in the hassle of providing the documents required of them by the lending company. As the question of whether the developer will provide them, please remember that not all developers are willing to accept Pag-IBIG Financing. As a matter of fact, many of them would rather prefer that you use bank financing.

2. Sorry, this is one of the primary confusion around here. I think I should write an article on this. Here’s an idea: Before you even begin transfering the title on the buyer, the buyer should secure a Letter of Guarantee that the loan is already approved. Take note, it’s a Letter of Guarantee, no lending institution will be playing tricks with you here. So that means the Registry of Deeds can start process the transfer now and annotate the title.

3. They will release an amount that is based on their assessment of the property’s value and your capacity to pay.

4. Are you buying a house and lot? If yes, then Pag-IBIG would want to see the house constructed first before even accepting your loan application.

As to your other question, if that land is owned by your relative, you can arrange that with your relative. The question now becomes: will

your relative accept a lower amount? That is, only the loan amount approved?

@Kat:

Yes, you can’t take a fiance to be your co-borrower.

Thank you Admin for your answers. About my last question, Given that Pag-ibig appraised the property as 1 Million indeed, same to how much it is being sold, and also given that my loanable amount is 750K assuming that I met the salary, number/amount of premiums, and other factors to consider when talking about the loanable amount – the question is, since I am not going to pay the 250K equity, will Pag-ibig release the 750K? Or will they still ask for a document stating that I paid the equity or something like a document which states that the equity is waived? I asked this since you mentioned on your previous answers that the equity is required and this is the basis that Pag-ibig uses to evaluate how serious a buyer is to acquire the property. In my case, I am serious, and since we are relatives, we arranged about the downpayment internally. Kindly advise.

hi admin ask ko lang po if pwede na mg avail ng loan if u were more than a 2 years member na po sa pinas and just 3 months member as a pop..thanks

Good day, Admin!

Question lang po, my net income is 6,400.00 capable po ba ako to loan

P 400,000.00? for 30 years. Thanks po.

Good day!

Question.. what if I only want to buy land only from my friend and it’s only P150,000.00 is it possible to buy it thru pag-ibig?

hi admin, tanong ko lang po na kapag sa individual seller ka at walang broker kailangan po ba na ang collateral ay nakapangalan na sa bibili

at talaga bang original ang dapat ipasa. my husband is a policemen, he had only left 15 years in service, pero ako gusto kong term ay 25 years possible po ba iyun, parehas naman po kaming may work, thank you and god bless

hi admin, tanong ko lang po na kapag sa individual seller ka at walang broker kailangan po ba na ang collateral ay nakapangalan na sa bibili

at talaga bang original ang dapat ipasa. my husband is a policemen, he had only left 15 years in service, pero ako gusto kong term ay 25 years possible po ba iyun, parehas naman po kaming may work, thank you and god bless

@Yzac:

A transaction like this should be entered into by all parties as formally as possible, with all the right documentations. In your case, both you and the seller (a relative) should execute a Contract To Sell stating the selling price, the amount of down payment, etc. even though. If you have both agreed, in principle, that he is not receive the down payment, then so be it; at least it is stated in the CTS that he received it.

Good day, Admin!

Question lang po, my net income is 6,400.00 capable po ba ako to loan

P 400,000.00? for 30 years. Thanks po.

gud day po may question lang po ako…nakapag contribute po ako for 26months since 2004-2006 then nakapag loan na rin po me…ang kaso po nakapag abroad me di ko na naasikaso ang naiwan ko na loan ko as in di ko nabayaran kahit isa last month po pinaasikaso ko sa tita ko kc gusto ko bayaran ung naiawan kong loan then ang sabi po ng pag ibig deducted na po raw sa hulog ko dati so clear na ung loan ko..possible po ba ung ganun talaga? may pagbabago po ba dun sa 26months na inihulog ko kung diniduct na ung loan ko dati? sa ngaun po i want to be a member for POP para sa OFW po at gusto ko po bayaran d2 abroad for 24 months pwede po ba un? balak ko po ipasok for loan ung binebentang apartments property sa akin ano po ang dapat ko gawin? makakapagloan po ba ako kaagad kc since 2006 till now di na ako nakapagcontribute pa? and hanggang magkano po pwede?

good day, po!

OFW po ako, ask ko lang po sana kung pwede ko ba i-loan iyon binebentang bahay ng aking sister?wala kasi nagaasikaso ng bahay niya kasi nasa ibang bansa din sila mag-anak. anu-ano po ba ang mga dapat gawin at mga requirements?

salamat po.

hi admin na late ako ng payment starting may 2011 to july 2011

so ngkatanggap akong warning but i was able to pay just for the month of may 2011 then last aug 2011 i was able to pay for the month of june im still 2 months behind my balance pero nkatanggap pa rin ako ng notice of default last aug 16 2011 dapat ba full 3 months bayaran ko o pwedeng paisa isa lang hanggang mahabol ko ung balance…

umaasa sa madaling reply thanks po

@Joan:

If you base it on the Table, then with that income you can indeed finance a 400k loan at 30-year term.

@alex:

Actually, any missed payment is already considered a default, but once you reach 3 months of non-payment then that property will be due for foreclosure. Please take that notice seriously and do whatever it takes to save your property.

thank you for the quick reply.. more power and GOD bless

Hi Sir. What if the property is being sold at 599,000 and sabi po sa leaflets ng property, and net income requirement daw po is 12,800, samantalang 3800 lang naman ang monthly amortization. Ang net income ko po is around 10,000 lang. Pero I’m single and 2 kami ng boyfriend ko ang magbabayad. Madedeny po ba ang housing loan ko if this is the case? me magagawa po ba ako para po ma-approve po ang loan sa PAG-IBIG?

Thank you. I just wanna send you a kudos kasi your site has been very helpful to me and very informative.

Follow up question: Does it mean po ba i can rely on the table above 100%? Kasi po ang sabi ng developer sa akin, with my net income 380k lang daw ang pwede kong i-loan. or may ibang factor pa po ba ang pwedeng maka apekto sa amount na pwedeng i-loan. Thank you po ulit.

@susan:

You can probably meet the monthly payments on that loan amount, but Pag-IBIG would want to make sure you are less of a risk to them. My suggestion would be:

1. Get a co-borrower

2. Or, get a lower amount of loan by putting more money as down payment. You may ask for help on this one.

Good luck!

@Joan:

Please have yourself pre-qualified at Pag-IBIG. That way, you can get an official assessment on how much you can loan.

Thank you for the reply Sir. Someone suggested to me to present other sources of income daw po. For example, remittance po na pinapadala sakin ng kuyang nasa abroad. Kelangan lang daw po ng reciepts ng remittance. Tanong ko po sir is ano po ba ang process ng pag-qualify ng PAG-IBIG. Me interview po ba or do they only rely on your net income documents (COEC and payslip). What if po, you have other sources of income (i.e. sari-sari store or online selling) pero wala naman kayong paper to serve as proof of extra income. Makukuha po ba yun sa interview lang?

my father died last aug.8 during his contract on jeddah,saudi arabia..my question is how will i know if my father is a pagibig member?and if so..do we have something to claim?

@susan:

By income they mean a documented income… so there has to be a document to prove that one. 🙂

@bhing1980:

Sorry to hear about that. Please check it with the Pag-IBIG Office or you can ask around from his former co-workers.

naghousing loan na po dati ang mister ko sa cavite naaprove po yun at nakapag umpisa po kami mag hulog ng ilan months sa equity pa lng po pero sinurender po namin kasi po bigla po nalipat ng batangas yung work nya kaya po di na nmin natuloy yun..balak po namin ngayon na mag loan ng bahay na naforeclosed na pwede pa po kaya sya maaprub ng pag ibig?sana po mapaliwanagan nyo kami tungkol dito thanks po in advance.

Hi admin,

I am an investor. I would like to sell my property to a Pag-Ibig Member. Is it possible?

1. The property is still in in-house financing, can I sell it in this condition?

2. Or do I need to fully pay the property, and have the title under my name, before I can sell it?

3. What else do I need to provide in order for me to sell my property to Pag-Ibig Member?

4. How long does it usually take for a Pag-ibig Member to get the financing from Pag-Ibig?

5. How does the Pag-ibig assess the value?

a. Is it against the current market value?

b. Or is it the seller’s asking price?

c. How much equity is needed?

Thank you so much in advance.

@Linda:

Yes, it is possible to sell it to anyone even to non-Pag-IBIG Members.

1. Sure.

2. You can do that too.

3. Lot of documents likes Land Title, Tax Declaration, Deed of Sale, etc. It would help if an investor like you should get a lawyer.

4. It depends on a number of factors, but ideally 2 months should be long enough.

5.

a) they will do their own assessment and yes more or less on the current market value of the property.

b) Usually it’s lower than the selling price. They always thought of sellers as suckers when it comes to the selling price.

c) It depends on you and the borrower’s loan eligibility.

Sir, I read here na pwede po mag apply separately ang mag asawa. May I just clarify, can my husband and I apply separately in Pag ibig for the same property? Kc po 4M po un property na balak namin bilihin and since 3M lang ang max, can both of us apply separately, tig 2M loan kami halimbawa. Thank you po.

Paano po magapply ng Housing loan para makakuha po ako ng sariling bahay?matagal na kasi ako nangungupahan, Gusto ko magkaroon ng sariling bahay, pero wala akong pambili, pero matagal na ako member ng pagibig.

Hello po, ask ko po 14 years na po ako nag huhulog ng contribution ko sa pagibig fund, employer 100 + sa akin po 144 = total 244.00/month. my net disposable income 4,500.00 single po ako 40 years old, may lupa po ako sa isang subd, worth 130,000.00 complete with title, gusto ko po mag apply ng housing loan, possible po ba na maka loan ako ng 500,000.00 @ 20 years to pay? please reply..salamat po.

ask ko lng po,bali seaman po ako,tapos gus2 ko po mag avail ng loan for home improvement, kaso magwowork na po ako this sept, pwede po ba na ipaco borrower ko ang mother ko since sa kanya ung bahay and kasi sa overseas ako nagwowork at need ng mag aasikaso nito d2…

no, 2 question ko eh ano po ba magiging problem nmin if ung nakalagay sa title ng lupa namin eh mas malaki kaysa actual?kasi nagamit na nung kapitbahay ung lupa na kinatatayuan, ano rin po ba ang magiging difference ng home improvement sa pagpapatau mismo ng haus since h.i ang dineclare mo pero almost 90 eh fully construction kasi mayroon ng structure doon?

ask ko rin po pala about doon sa plan nung bahay,kasi im confused po if ipapagawa lng namin sa hindi mismo developer,may draftsman lng po but may engineer lng po na magaasikaso at titingin and then ung sa cost ng construction kasi we are trying to minimize the cost kaya sa kakilala lng namin na expert ipapagawa

@hai:

Please check it using the Table of Income vs Loan Amount Entitlement as shown above on this article.

@Romel:

Please search it from the other pages of this website.

@jersey:

Interesting! But in this case, that’s not possible.

gud pm sir/mam ask ko lng po kc 2 yrs n akong army gusto ko sanang mag loan ng housing loan or pang renovation pwede po ba akong mkapag loan khit mga 800k…khit walang plano ng bahay,…ty…pls reply to my no. ~-~-~ number deleted by admin ~-~-~ ,,,,thanks

my hotline b kau….or my branch kau sa tarlac

Hello po, mag apply po ako housing loan, kaya lang wala po ako income tax return ito po yung isa sa mga requirements, ok lang po ba kung certificate of employment & compensation and 1 month latest payslip ang submit ko?

Thank you.

Hello po,

I am facing difficulties sa pagbayad ng lupa ko sa Bulacan for one year pero gusto ko na po syang ayusin. Ask ko lang po kung pde ko po ireconstruct..lot lang po yung nipurchase ko..please help me po..my email address is ###– email address deleted by admin –####

Goodmorning po,

I am Jane, currently working sa Dubai. I purchased my lot last 2008 sa Malolos Bulacan. Nakapagdown nman po ako at nakakapagbayad before pero nagkaroon po ako ng financial difficulties kaya po natigil yun since September 2010. One year na po ako hindi nakakabayad ng monthly dues ko na 4,900 PHP. Ngbrowse po ako sa google and thanks GOD nahanap ko po itong website na ito. AYoko pong bsta mawala itong lupa sa akin dahil malaki rin po ang naidown ko dito. Nagkataon lang po na nagkaroon ako ng financial problem. Ask ko lang po, ano po ang mga steps na pde gawin para ayusin to. ANg problema po ay nasa Dubai po ako. Pde po bang ang pinsan ko ang umayos nun para sa akin?Ayoko pong makuha yung lupa ko. Meron po bang reconstruction yun?Maraming salamat po. Talagang gusto ko pong isave ang kaisa isang lupa na pinaghirapan ko po. Paki email po sana ang instructions kung paano po gagawin. Marami pong salamat sa inyo. Malaking bagay po yung mga magiging sagot ninyo para maging panatag ang loob ko.

Hi,

Ask ko lang po kung paano malalaman kung ilang percentage ang down payment?

Thanks

@jane:

It’s important that you check the status of your loan at the office. Have your representative do that.

@hai:

The ITR is one of the requirements. You can’t skip that one.

Hi i’m irish of cavite. Is there a possibility na di ma approve ung housing loan sa pag ibig? For example, I already submitted my requirement including the coe na notarized. Then after a month of submitting all of the needed docs, I decided to resign with my employer and transfer to different company? I just wanted to know if this can be a reason para di ma approve yung housing loan ko since pag ng backgroung check ang pag ibig with my new employer and status ko ay probationary or not a regular employee? Thanks in advance. More power.

Admin,

Tanong lang po… I want to take a loan from Pag-ibig para sa house

contruction.. magkano po required na equity ni pag-ibig para marelease po ang ang aking loan.

Im planning to loan P1M po sana.

Thanks in advance.

@irish:

You’re right. A Loan Application can never give you any guarantee of approval.

@Bev:

Usually you will be required to put a 30% equity amount. But be smart, have at least 50% in buffer money just in case you loan release will be delayed. Please

be informed also that you need to shoulder the initial construction of the house.

i contributed 35months sa pag ibig 8yrs ago and naputol nong nag abroad ako., i want to continue and upgrade my contribution to POP i ask my father to go to pagibig office and he pays 4,000 for 4months contribution. Now i check on this site http://www.pagibigfund.gov.ph im surprised that i cant see my transaction history and contribution… Is the pag ibig online verification is updated? or the website is still under maintainance?

Hi ask ko lang po.. kasi po nag loan po kas kmi ng wife ko last month? e nakapag C.I. na po this week.. ask ko lng po ksi may chance po ba madisapprove if wala pa nakita na pag uumpisa sa aming house construction? kasi po nakita lng ng nag C.I eh mga gamit like ung mga bakal na buo na na ilalagay sa fundation and mga kahoy po.. ask ko lng po may chance po kya ma disapproved? pag wala pang nakikita na hindi pa ko nagpapasimula? kaya ko naman po hindi makapagsimula eh baka po hindi maapproved eh sayang naman po pag nagpaumpisa ko eh d hindi na po maitutuloy if madisapprove ang loan namin… Pls comment asap .. tnx

How to compute monthly MRI & Fire Insurance for housing loan?

Hi Pagibig,

Nareceive na namin un Notice of approval with the Disclosure statement which states our monthly installment/amortization for our housing loan. Ask ko lang, magkaiba ba yung monthly contribution na being deducted sa salary from the monthly contributions na nakaindicate sa kasama dun sa total monthly installment/amortization? Baka kasi madoble un pagbayad namin ng monthly contributions.

Salamat!

@Carlos:

That could be an additional contribution that you have to make which is added on top of the regular contribution.

@Gigi:

Sorry, I forgot the exact figure.

@jayson:

I think your loan has already been approved, so you are already assured of getting it. But take note, the release of the fund will be based on the progress of your construction.

@Alex:

The system is not yet fully functional nor the database updated on a real time basis.

Hello admin, tanong ko lang po about sa mga bahay na pa-assume already under pag-ibig. Kung hihingi ang seller ng let’s say 300K para ma-assume ko ang bahay, pwede ko ba itong isama sa amount na iloan ko sa pag-ibig? Para ang Pag-ibig na ang magbabayad sa kanila ng cash na 300K?

Hi Admin, I wanted to avail the pagibig housing loan to purchase my dad’s house and lot. I’m working in a BPO industry here in the Philippines and my current base pay is 30k with 200PHhp monthly contribution. My wife is also working in the same company with a base pay of 25k and 200php pagibig cont. I wanted to be approved at the maximum loanable amount and planning to pay in 20 years.

My 1st question: Since i’m already married, will pagibig consider both of our monthly income and pagibig contribution?

2nd question: Granting the assessed house and lot amounts to 2M, how much can be my loanable amount be?

Thanks in advance.

hi admin good day po,,,, ask ko lang po kung ang monthly contribution ko ay peso 1,200.. pwedi po bang maka avail ng multi purpose loan worth of 1m- 2m?…. at ano po ang ibig sabihin ng PER ANNUM? kc hindi ko po alam ang mga yan kya po ako nagtatanong para malalaman ko kung ano po ang ibig sabihin ng PER ANNUM… kailangan ko po ang mga kasagutan maraming salamat po….

Hi admin Good Morning!

I worked as a Medrep for the past 2yrs & 5mos..And now Im 3 mos employed by my new employer,pwede po ba ako mag apply ng housing loan khit 3 mos pa lang ako sa new employer ko?worth 500k po ung house & Lot and my net income is 13k.

Sorry, more questions regarding NDI:

1. Who determines this and how (like do they estimate transpo cost, food cost?) Is this part of the evaluation of our loan?

2. NDI covers Monthly Salary (net of taxes, SSS contributions), can we include allowances (such as Gas Allowance, Rice Subsidy)?

Thanks!

Hi Admin,

Ask ko lang po kung halimbawa na aaproved ako sa housing loan then ungoriginal na design ng bahay ay diko sinunod kasi nag bago ang isip ko sa design at ayoko ng magpagawa ulit ng plano maapektuhan kaya un? I mean di kaya sila mag release pag sa unang inspection at nakitang iba na ang yare kesa plano, eh ano kayang maaring mangyare?

Thanks and regards

hi!i forgot my rtn..how can i retrive it..thanx

hi admin

ask ko lang kung allow ba kami mag housing loan ng 1.5M if our combine monthly salary is 35K.. actually twin pod yung house,each house cost 850k then kukunin namin dlawang unit kya 1.5M.

Thank you..

hi adming gud day, may i ask if pwede na po ako mag avail ng housing loan and kasi ang contribution ko monthly ay P247 only my monthly salary around 18K lng po, as of the table loanable amount ko ay 500K pwede po ba ito ma-up ang loanable amount ko? thanks wait lng po ako ng reply.

mag kano po ang kinaltas ninyo sa pag ibig premium ko na binayad sa bahay ilang buwan po ba ang binayadan ko po arears sa inyo po

Good day po.

I’m planning to buy a lot thru pag-ibig…what if the lot cost 175K? can i still loan higher than that and planning to invest for example building a house on it or doing a business?

And what if the lot is not in subdivision, i mean sa baryo lang po sya.

Thank you so much.

Best Regards,

Leo

sir/mam, is there a possibility that a member can assume 2 housing loan?

Sir / ma’am,

ask ko po,kung pwedi po ako maka avail ng house in lot loan, ofw po ako, member na po ako last april 2010, prob5 ko lng dpa po ako ng umpisa mgbayad, which is requirement sa loan ay dapat nkabayad atleast 24 months, plan ko po mg apply sa january para sa loan, pwedi ko ba e-cover ung 24 months sa isang bayaran lng at ano po ang duration ng pag process para maapproved ang loan f sakali pwedi ako mag loan. maraming salamat po…

additional po, mayron po ba kau contact no. o ahente ng pag ibig na pwedi ko e submit mga documents ko kung sakali pwedi ako mka loan, base ko po sa dubai… salamat po….

Hi Admin,

Nagpla-plano po kami ng aking tatay n kumuha ng lupa sa Cavite. We dont know kung san kami mag sisimula. Ang tatay ko po ay Pagibig member na for more than 20 years at ako nmn po ay almost 1 year palang na member. gusto ko po sanang malaman kung pwede ba kaming mag loan. ang lupa po kasi na inaalok sa cavite ay 80sq.ms lamang po. Para sakin akoy naliliitan dun sa sukat naun.

Naway matulungan nio kami. ang aking tatay ko po ay may basic pay na 20+ at ang aking basic pay naman po ay 15+. kung kailangan nio pa po ang karagdagang inpormation. paki contact nlng po ako sanaibigay kong email address.

Maraming salamat po.

Hi Admin, gusto ko lang sanang malaman kung paano ang proseso kung, magloloan ako ng Bahay at Lupa. Ito ba ay diretso sa company na bibilhan ko o mapupunta muna sa akin ang pera at ako ang magbabayad sa company na bibilhan ko ng property. At makakapagloan ba ako ng financial (Pera sa Pag-Ibig)?.

I hope please answer my some questions.

Thank you very much.

hi admin,may tanong po ako,kc may nagbibenta ng bahay samin,bale 1 yr nalang tapos na po cia sa pag-ibig..pwede po ba namin i apply sa pag-ibig? cno po ang mag pa price nun cla po o ang pag-ibig,pwede po ba yun ibenta kahit hinuhulugan pa nila sa canada napo kc may ari..salamat..

@tess:

You can assume it from them anytime. But since there’s only 1 year left, it’s best if you wait for them to fully pay for it and then buy it from them. Of course as the owner of the property,

they are the ones who will set the selling price of the unit. Pag-IBIG’s job is to appraise it, but eventually you will have to follow the price set by the owner.

@Abel:

What will happen when you are granted a real estate loan is that, Pag-IBIG will pay the seller (developer) and then you will pay the Pag-IBIG Fund.

@Jeffrey:

The answer to your question is Yes. You can both apply for a Home Loan from Pag-IBIG either individually or jointly.

@nhadz:

The 24 months contribution is the critical part. You have to pay it first.

@merab:

Pag IBIG only allows one housing loan at a time.

@leo:

The loan amount that will eventually be granted to you will be based on the appraised value of the property. As to the kind of lot, it must be a residential one and

Pag IBIG will also evaluate the title.

@vienvinido:

Please check it at the branch.

@Ryan:

As you can see from the Pag-IBIG Table shown, one of the ways you can get a higher loan amount is to have a higher income also.

@Ritz:

Please review the Table shown above.

@Victor:

That would create a confusion on the part of the evaluator / inpector and it could drastically affect your loan release.

@Marichelle:

Since you are already more than 2 years as a member, you may be eligible for the loan.

@mhel:

Per Annum simply mean “per year”. And regarding your question on MPL Loan, please be informed that it will be based on your total accumulated value.

Please read the article linked below.

https://www.pagibigfinancing.com/articles/2010/can-i-pay-24-months-contribution-so-that-i-can-avail-of-the-housing-loan/

@Karl:

Yes, you both can apply for a single home loan. And the loan amount will be based on your combined income. Please take time to read the article above as a review.

@Grej:

Yes

hi admin OFW po ako.. ang salary ko po ay 20,000 peso can i loan worth of 1m then i pay for 5 yrs pwedi po ba yun?… at yung magloan talaga po bang ay 20 percent? eh kung wla pong bang bayad ng equity pwedi po ba na e deduct nlang po sa ma eloan?… kc nakita ko po sa chart na sa 1m na ma e loan ay 200,000 peso ang equity…?

hi admin yung equity yun po ba nag down payment? kong wla pong ikapagdown pwedi po ba na e deduct sa amount na ma e loan? and i pay in 5 years?…

Gud day!bkit po after pa ng DP b4 maprocess ang loan application?and much better b kung ang developer ang mgprocess, could it take too long?tnx

hello..tatanong ko lang is about my lona.nagloan po ako and it’s in process na daw and marerelease lang daw sya pag natpos na yung mga bagong documents na inaask nila one of this is with the BIR, btw my sister is the one who is assisting this kasi ofw ako, and yung property na niloloan ko is to acquire my sisters property and to transfer the title sa name ko i need to have the docs na inaask nila.My question is , is there anyway to pay the 8% na need ko byadan sa BIR, kase medyo mabigat yung 8% nang 450k which is the amount na niloan ko..pede ba syang hulugan sa BIR.. Thank you very much God bless..

Can I still continue my contribution using my pagibig membership even if I’m already separated from the company? If still possible? how’s the process? Can I just show my hardcopy of contributions to the nearest pagibig branch and just continue paying monthly? Also I am now an OFW and i would just like my sister to act as my representative to arrange my membership. Would that be also possible? Am I also entitled for a housing loan after I finished paying 2 years, 500 per month??

Good day po! Can I still continue my contribution even if I’m already separated from my company? If yes, what are the requirements? I am an OFW now, so can my sister act as my representative in any concerns regarding my membership? Am I entitled to a house and lot loan after 2 yrs even if my contribution is only 550 per month?

ask klng po sir kng pwede magloan 4 apartment construction ofw po ako member ng pop tnx godbless…

good am admin,tanong ko lng po tungkol sa CTS GOLD FINANCING SCHEME f ok ba itong scheme na to?bcoz the developer they want us to use this scheme instead of pag-ibig for 1-2 years..actually po,yung equity pa lng yung binabayaran namin at sa april 2012 pa matatapos.at ngayon sabi ng developer since im here n abroad,they want me to use this option which is the cts gold financing.what is the advantage nd disadvantage of this CTS GOLD FINANCING SCHEME?THANK YOU ND MORE POWER!WAITING FOR YOUR REPLY

Hello. My husband and I are planning to get a housing loan worth 1.8M. Our joint monthly income sums up to P40,000. Blae magkano po kaya ang monthly amortization namin? Thanks ADMIN.

@Kim:

Please re-read the article above. The answer to your question is already there.

@Melvin:

Sorry, but I don’t have any idea about the Financing Scheme that you mentioned.

@jonathan:

Yes

@Dorin:

Your Pag-IBIG membership will never depend on your employer so you can stay active even if you are changine employers from time to time. And yes, you can have your sister

act as your representative here to do the transactions on your behalf.

@ofelia:

That’s on the side of the BIR already. But personally, I don’t think they allow installment payments. 🙂

@joy:

that because the down payment is one of the requirements. But you can process it while still paying for your down payment. Just ask the assistance of your developer or broker /agent.

@mhel:

Yes, equity is also the other name for the down payment. YOu have to shoulder that one.

As to the loan amount that you can get, please read again the article above.

maraming salamat sa pag sagot nyo sa mga katanungan ko…. salamat po… and god bless

Hi Admin,

Pwede ko po ba i loan sa pag-ibig ang bahay na binebenta ng sister ko? clean title, amilyar etc. at currently don po ako nakatira. pero yung sister ko po nasa ibang bansa pls. advise..

Thanks

Thanks admin for your feedback. I still have questions po, I know it seems stupid pero hindi ko po kasi alam kung ano ang mga procedures if I want to own a lot thru the help of PAGIBIG. Andito po ako sa Taiwan at gusto ko po pagbalik ko magloan ako sa PAGIBIG para pagbalik ko dito uli sa Taiwan huhulugan ko nlang ang loan ko. Sa PAGIBIG po ba makikita kung saan sa area namin ang merong bakanteng lupa? then magaapply ako ng loan, babayaran ang equity and pwede ko n hulugan monthly ang loan sa PAGIBIG? pasensya na po 22yr-old plang poh ako at wla pa msyado knowledge kung saang government agency ang dapat puntahan, all I know is that PAGIBIG handles housing loan. Thanks in advance po for the assistance.

hi po,ask ko lang po kung pwede po ako maka avail ng housing loan nag start po ako ng hulog august this year tapos nag advance na po ako ng one yr deposit ,at 2oo per month po ang deposit ko balak ko po i upgrade ng 500 kailangan ko pa ba mag inform sa pag-big na upgrade ko ng 500pesos?nxt year po pwede din po ba ako mag advance ng another 1year para magkaroon po ako ng 2yrs remittance.balak ko po mag apply ng housing loan next year din po mga october pwede po ba yon.thanks u po

ask ko lang po. what if po may previous loan ang isang tao tapos may present loan na ulit sya pro may balance pa sya sa previous nya. ino-offset po ba ang previous balance ng loan sa bagong loan?

@janine:

YOu must be talking about the Multi-Purpose Loan. Yes, you are right.

Please refer to this link for more information:

https://www.pagibigfinancing.com/articles/2011/more-on-pag-ibig-multi-purpose-loan/

@Charry:

You can always contribute any amount bigger than P 200. There is no need to notify them about that. And remember that

the minimum membership requirements is 24 months and you must be active by the time you apply for a loan.

@Dorin:

Please read this article on the loan application process:

https://www.pagibigfinancing.com/articles/2010/the-pag-ibig-housing-loan-process/

And about the vacant properties, you can check them from the sellers: agents, or real estate developers in your area.

@Raffy:

Yes, that’s possible.

good day po,isa po akong ofw.tanong ko lang po,nag loan po ako ng 1,250,000 sa pag ibig para sa bahay ko,nabasa ko po d2 na ang monthly ko ay 11,000,bakit po sa ngaun ang aking binabayaran ay sobra sa 13,000.kasama pa po ba yung insurance at fire na tinatawag nila sa bayaran kada buwan.sobra po kasi laki ng monthly ko.marami pong salamat…

Hi Admin,

Hope you can answer my question. I have acquired a condo worth P2.1M and the 20% will be fully paid by next year. The remaining P1.650 will be the amount I suppose to loan. Now my salary is only P15,000 but I have other sources of income not registered as a business but have proof of deposits worth P25000 monthly. Can I show my bank records with my salary to be granted a loan? thanks

Thanks much admin! you’re such a big help…:)

Merry Christmas poh…wishing you traquility, more success, & good health for you and your family!

@jun:

Yes, you are correct about having the insurance and other payments tacked into the monthly dues.

@lex:

Yes, you can do that, but it still depends on the loan officer. If not, please try to get your loan from your bank.

@Dorin: