In the previous article about amortizations, you learned how to determine the monthly amortization given a particular loan amount, loan term (in years) and interest rate (per annum).

It is very important to bear in mind that these three factors primarily determine the scheduled amount of the monthly amortization.

This article somehow extends on the previous one and here I’ll discuss the following topics with the help of an online mortgage calculator, which is also included here:

- How to generate the Monthly Amortization Schedule.

- The two components that go into the monthly amortization: interest and principal dues.

- As the title of this article says, “How to save on your loan payments.”

The Mortgage Loan Calculator

With the help of the Mortgage Calculator shown below, let’s see how the amortization schedule looks like on a monthly basis.

Important Note When Using The Mortgage Calculator: When you click on the Calculate Button, the result displays in a pop-up window. To close the window, simply click the Close Button located at the upper right corner of the resulting pop-up window.

As you can see, the tool has some default values already and if those values perfectly match your loan, all you have to do is click on the Calculate Button to show the results. But for most of us, our cases are of course different from the default example.

Let’s say your property costs P 2,000,000 and you are to put 20% down payment up-front — that should be P 400,000 out of your pocket. Furthermore, let’s say that the going interest rate in the market is 10.5% per annum and that you plan to pay the PhP 1,600,000 loan in 3 years only. From here, you want to determine the following:

- Monthly Amortization Amount

- Monthly Amortization Schedule

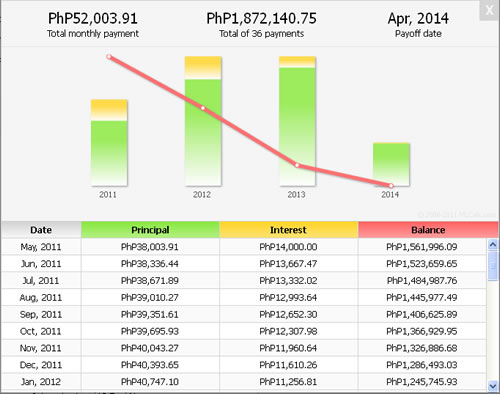

If you have entered the right values from the calculator shown above, you should get the monthly amortization at PhP 52,003.91 and that the total amount paid in interest for the whole 36-month duration of the loan should be PhP 272,140.75 (see at the bottom part of the resulting Amortization Table).

Here are some graphics to visually guide you on the results.

Figure 1 : Monthly Amortization Table for P 1.6M loan payable in 3 years at 10.5% interest rate.

The Amortization Table above only partially shows 9 months out of a total of 36 months amortization schedule.

You will find the total Principal and Interest Payments at the bottom of the Tabular data when you scroll it down. It should look like this on your screen:

Figure 2 : Monthly Amortization Table continued from the previous Table. This time, only the last part of the amortization schedule is being shown.

If your results don’t match with this one, please do it all over again until you get it right. This is a very powerful tool of analysis right at your disposal.

More On Interest and Principal Dues

Take another look at the resulting Amortization Schedule Table.

If you add up the Interest amount due and the Principal amount due at any row, it always results to 52,003.91.

That magic number is not at all magical. That’s your monthly amortization!

In other words, the amortization consists of two components, namely: the principal due and the interest due. Each payment that you make against your scheduled amortization, a portion of it goes to the principal payment and the other portion goes to the pay the interest.

From the example above, your first monthly payment of 52,003.91 pays for the PhP 14,000.00 interest and the PhP 38,003.91 principal. On the second month, PhP 13,667.47 is allocated for the interest payment and PhP 38,336.44 for the principal payment.

How To Save on Your Loan Payments

Have you noticed that at the early part of the schedule – that’s the first few rows of the tabular data – so much goes into the interest payment and only a small portion goes into the principal payment? And at the later stage of the schedule, a small amount is now allocated to the interest while the bigger part now goes to the principal.

(Actually, this will become more apparent at longer loan terms, say 15 or 30 years.)

This is always the case for mortgage loans: it follows the Declining Balance Model. That is, assuming your payments are religiously made on schedule, the principal balance is reduced over time and the next schedule is also smaller since the interest is always applied on the remaining balance.

So in other words, if you make a payment that is greater than the scheduled amount, the excess value is deducted from the principal, reducing the remaining balance further.

Actually there is a two-fold effect when you make advanced payments against your mortgage loan:

- you save on the interest payments

- you pay off your loan earlier

From here, we can say that one of the ways you can save on your loan payments is to make advanced payments. This way, you are actually save on paying the interests.

There are methods that help you determine the effects of advanced payments at any period of your amortization schedule, but we won’t discuss that in this article yet. Suffice it to say, that making advanced payments is almost always to your advantage.

~~~

This article on Mortgage Calculator and Amortization Schedule is written by Carlos Velasco.

Wow, this loan calculator you just presented is so amazing! I tested it on a 20-year loan term, and the numbers are really showing — how much goes to the interest and how much goes to the principal.

I like the way it renders the bar charts and the line graph. Thanks for this very informative article.

Good luck to you guys at PagIBIG Financing website. Keep up the good work.

How much will be the marked up interest if your monthly payment in pag-ibig housing loan is delayed for just how many days only?

wow! now I see it’s better to buy a property in cash than finance through PAG-IBIG. The interest almost exceed the principal, you can even buy another house with that interest!

Thanks to this informative blog, I now understand the reason why almost all of my monthly payments just go the loan interest.I’ve been paying more than P8k for 7 months now, and out of the P56k only P5k has been deducted from my original loan. I’m now considering on paying a (way) higher amount, but I’m afraid that it might just end up being “eaten” by the interests. Since I heard that my uncle paid P200k one time before, and out of that amount, only around 20k was deducted from the original loan. Is this really possible? If you have any advice, please do tell. Thanks for your time, and keep up the good work!

@Riz:

I appreciate your comment. As to your uncle’s case, I’m not sure what happened. But if you should pay that much, see to it that you first request a Statement of Account so that you will know your current balance. Also after paying that amount, keep the Official Receipt. Then ask for another Statement of Account just to make sure that your payment has been posted. 🙂

Hello admin, tanong ko lang po about sa mga bahay na pa-assume already under pag-ibig. Kung hihingi ang seller ng let’s say 300K para ma-assume ko ang bahay, pwede ko ba itong isama sa amount na iloan ko sa pag-ibig? Para ang Pag-ibig na ang magbabayad sa kanila ng cash na 300K?

ASK KO LNG IF MAGLOAN AKO NG HOUSING LOAN KAILANGAN BA NA IKALTAS SA LOAN KO ANG PAGLIPAT NG TITLE NG BAHAY,BARROWER BA O SA DEVELOPER NA ANG BAHALA SA PAGLIPAT NG TLTLE?

Sir,

Bago po ako nakapagLOAN ng 427,000 sa PAGIBIG FUND HOUSING LOAN, nagbayad ako ng 2 years para sa PAGIBIG MEMBERSHIP FEE para ma-qualify ako for Housing Loan.

Ngayong nagbabayad na ako monthly ng aking housing loan.

Ang tanong ko po, kailangan pa rin ba na patuloy ako magbayad buwan-buwan ng Monthly Membership Fee kasabay ng pagbabayad ko sa aking monthly amortization for Housing Loan? 🙁 CONFUSING PO 🙁 Di kasi naniningil sa membership fee since I started the housing loan on April 2003 pa, baka magkaproblema ako 🙁

In short,

MONTHLY MEMBERSHIP PAGIBIG FEE + MONTHLY AMORTIZATION FEE FOR HOUSING LOAN = TOTAL PAGIBIG FEE KO?

Pakilinaw po….wala kasi nag-aadvise dito 🙁

Salamat po 😀

ANTHONY L. TAN

HLIDNO: 315009038617

Sir/Madam:

verify ko lang poh ang Statement of Account ko from Pagibig Fund Collection, Acccounting & Ledgering Office as follows:

MRI 175.10

FIRE 105.75

MAF 0.00

CONT 400.00

HCF 0.00

PENALTY 0.00

PRINCIPAL 10,038.89

NON-INT..BEARING PRINCIPAL

ACCRUED INTEREST RECEIVABLE 1,730.15

Nawala kasi contract papers ko sa PAGIBIG.

I want to verify na lang about ” CONT ”

Ang “CONT” ba na acronym means PAGIBIG Membership CONTribution?

If yes, it means, kasama na sa monthly amortization ko ang Pagibig Membership CONTribution ko? Correct po ba? 😀

Ibig ba sabihin ng ipon ko rin yang membership contribution ay puwede kong iwithdraw sa Pagibig? Inosente kasi ako sa PAGIBIG 🙁 Parents ko lang nagprocess ng lahat sa housing loan 😀 Ngayon pa lang ako nagaaral tungkol sa PAGIBIG 🙂

Salamat po 😀

ANTHONY LABITAO TAN

Hi Admin,

I got a loan amount of 1.25m with 20 yrs term, last Oct 2009 with pag ibig, Currently i’m paying P13,328 monthly.My statement dated Jan 2012 is currently showing me a balance of 1.197M,it looks like as though i paid around P364k just for the interest.I’m planning to settle my remaining this 2012, i tried calculating my suppose to be interest if my term is 3 years and i got an amount of P191k . My questions are;

1. Am i going to get a rebate on the difference on the interest i already paid and the interest base on 3 years term?

2. Is there any charge for the early settlement of loan?

3. Let say i just paid 500k on my remaining balance, is it possible for me to change the term of the remaining into shorter period?

thanks in advance

Dear aAdmin,

I tried to look for your response of Kate’s queries. Please supply us the information we need. Thank you and looking forward to hearing from you.

Dear Admin,

1. Do we have repricing program? nagtanong kasi ako knina sa HDMF office nyo, wala daw gnun? How true it is?

2. What is the process & what are the reqts needed if for example i will be selling my H&L unit but mortgaged in PAg-Ibig?

Please advise. Thanks

hi admin,

im just going to ask…if di na ba bababa ang interest rate ng pag ibig sa mga housing loan na na take out ng earlier 2007, kc di ba under noli de castro na approve sya ng 6% wala na bang way para dun sa nagbabayad ng 12% pa din ang interest? saka ask ko na din if nag babayad ka ng monthly amort mo monthly ilang percent lng ba ang nababawa sa principal on a monthly basis… kc parang pag kinumpute mo ung monthly amort till maturation date eh parang triple pa ang binayaran mong bahay…now ko na realize ang laki pala ng tubo ng pag ibig? kala ko pa naman handa talagang tumulong…eh anlaki pala sobra ng tubo nyo….

Just want to know if you have any online site where we could check our monthly conribution just what SSS are doing…..the site that is http://www.pagibig.gov.ph or whatever is not a valid site for us and we cannot go through it…..

I have a housing loan at Malolos Bulacan branch. MY last two consecutive yearly mortgage payment(2010- 2011) and (2011-2012 ) was paid in advance over the counter at malolos branch. I understand that advance payment can save me from paying interest. How will I know If advance payments is actually saving me from paying interest..My representative in manila will go to malolos branch to ask for updated copy of my housing loan statement.. does this contain or reflects how much i was able to save from paying in advance??

Allan,

This is how you save by paying advance: The amortization due has a principal and interest component. Any excess payment that you make goes to cover the principal. Since the interest is based on the balance, you will be paying less since the balance is also lowered as a result of your advanced payment.

Dear Admin,

I have some clarifications on saving by paying in advance:

1. Do they(Pagibig) actually recompute and lower the interest on my next amortization? or

2. Will it only happen if I go their office and ask for a recomputation. How will this work?

3. If I’ll be paying in advance, and my loan (30 yrs.) principal would be paid off in let’s say 20 years.

a. Looking at the graph from the mortgage calculator, I will have paid most of the total interest. How does this benefit me?

b. I will have paid my principal earlier, and I think that would mean that Pagibig will also get hold and use of my money also earlier.

4. If I had invested my advance payments in other forms, would I actually save more?

Very insightful comments from the readers. I too have questions, but do look forward sa mga answers ni admin. Very helpful ang mga sagot ni admin, dami kong natututunan, kaya lang nabitin na… sana may updates/answers pa.

I’m back 🙂

I am eyeing a property to buy and am trying to decide between (1) refinancing my current home so that I can settle the new property in cash OR get a totally new loan for a lot and construction of house. Which is a better deal?

(2) When a DP is required (as in the calculator), do I pay the DP to the seller or to PAG-IBIG?

(3) may I take out the full amount as my total loan or will they only refinace the balance for my current home?

(4) before the release of the loan, the titles are required to be in my name only, how will I convince the seller to tranfer when I still don’t have the full amount to settle the TCP?

Appreciate you response and thanks for the insights you have already provided in this blog.

Rophe,

Good questions.

1. It depends on a lot of factors. You may also consider that fact that Pag-IBIG only allows one housing loan at a time.

2. The DP is to the account of the seller.

3. The loan amount depends on your qualification and the assessed price of the collateral.

4. Follow this link for the answer:

https://www.pagibigfinancing.com/articles/2012/land-title-how-to-register-and-transfer-it-in-your-name-as-the-real-estate-buyer/

This blog is AWESOME! Kudos to Pag-Ibig Financing! Keep it up!

I’ve no questions.. am just really impressed with this blog and how updated it is.

Dear Pag Ibig,

I was so confused after checking your mortgage calculator online…my husband was granted for a 930k housing loan for our purchase of house & lot with a developer last Feb. 2012, We opted for a 15yrs. term of payment, however our developer had informed us that it cannot be allowed in our case, so they decided to make it into 25yrs., now upon checking on your mortgage calculator on line….with our 930k; at 8.5% interest in 25yrs., it appeared that we should only be paying about 7,500/month, but why is it that Pag Ibig Dinalupihan branch computed that we should be paying about 8,500/month? Could it possible then for us to request to make it only for 20yrs., since monthly amortization is within our paying capacity? Hoping to hear from yous soon for an enlightenment & guidelines regarding this matter. thank you in advance & more power!

Hi Theresa,

The article states that the calculator serves only as a guide. The actual amount should include fees for: insurance, membership and taxes. The online calculator doesn’t include these things.

hello po,

ask ko lang po kse plan ko po na magloan for construction me and my husband are both member ng PAG IBIG, is it possible po ba na we can avail our individual housing loan since pareho po kaming member, and as of now po may Multi purpose loan po ako ok lang po ba na bayaran ko yung balance ko in full over the counter pra lang po ma update ang account ko tnx po.

Hi Admin,

In continuation with my previous queries, I am planning to get a 25 years pag-ibig loan. What if my financial condition will change in the next 4 years which is more likely to happen and I would like to pay the outstanding balance of the loan. Should I get a penalty for an early settlement, if so, how much?

Please advise. Thanks.

Magkano ba ang monthly na babayaran kong mag housing loan ako ng 400k magkano ang monthly?

Hi admin,

Ask ko po if possible ba maka-avail ng housing loan construction if we haven’t fully paid the lot yet. Only the equity has been paid. and possible din po ba na ung lot and house construction ang maloan? Thanks. =)

Hi Admin,

Magkano interest rate ng pag-ibig housing loan?

hello,

I have read the questions and comments.. someone has brought up a question similar to mine but there’s no reply yet.. I just want to know kung pwede q bayaran over the counter ung balance q sa MPL q? then after that can I apply for housing loan na? if yes, how soon? pls. email me with ur answer. thank u

ask ko po, may individual seller na nagbebenta ng lupa without title..pwede ko po bang iloan sa pag ibig para mabili yung lupa?..salamatz

ask ko po, posible po ba na mag loan sa pag ibig pambayad sa lupa na binebenta ng isang individual seller, yung lupa hindi pa titulado?..