When applying for a Pag-IBIG Housing loan, only two things can happen: Your loan application is either approved or disapproved.

Once your loan application is approved, the real work is just about to start. The most important, and tiring process here, is the registration and transferring of the Title in your name as the buyer of the real property – whether it is a lot-only property, a house and lot, a townhouse or a condominium unit.

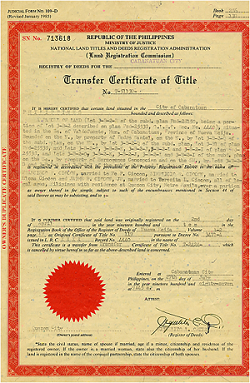

Depending on the kind or property that you are buying the Title here can mean any of the following:

- The Certificate of Land Title, which is also known as the Transfer Certificate of Title (TCT)

- The Condominium Certificate of Title (CCT)

( Related: What if my housing loan application is disapproved? )

Title Registration and Name Transfer

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

If you are buying a new property from a real estate developer, or through its marketing arm, they should be able to assist you in the registration and transferring of title in your name. This is one of the advantages of buying from a developer instead of purchasing a property from an individual seller, where the burden of registration is placed on the buyer.

Of course, you can always opt to register the property by yourself, if that’s fine with you and you don’t mind going through the whole process. Again, as already mentioned, if you are buying from an individual, you have to do the legwork of title registration.

In any case, we have outlined below the series of step you need to take to be able to properly register the Title of the property and have it in your name.

(See also : Citizenship, Land Ownership and Pag-IBIG Fund Membership )

STEP 1: Get A Certificate Authorizing Registration

- Go to the office of the Bureau of Internal Revenue (BIR)

- Once you are at the BIR, present the Deed of Absolute Sale (DOAS), and Loan and Mortgage Agreement (LMA)

- Request for the computation of the Documentary Stamps and Capital Gains Tax.

- Then proceed to the designated bank and pay for the Documentary Stamps and the Capital Gains Tax. (Usually this is the Land Bank of the Philippines.)

- Go back to the office of the BIR and your Bank Receipt

- Finally, request for the issuance of Certificate Authorizing Registration (CAR)

STEP 2: Request Issuance of New Title

- Proceed to the Registry of Deeds and present the following documents: DOAS, CAR and LMA.

- Pay transfer tax and registration fees

- Request for the following:

- Issuance of new Title under buyer’s name with proper annotation

- Certified true copy of new title (owner’s copy)

- Certified true copy of new title (RD’s copy)

- DOAS stamped received, LMA stamped received

STEP 3: Pay Tax Declaration

- Proceed to the Assessor’s Office

- Present the new Title with your name

- Pay for the issuance of the new Tax Declaration under the buyer’s name

- Secure a copy of the new Tax Declaration

Take note that the steps just presented are just a part of whole Housing Loan Application Process — probably up to the loan approval stage but prior to the release of the loan proceeds. After you are done with Step 3 above, which is the most critical and time-consuming of them all, you have to go back to the Pag-IBIG Fund office or branch that approved your loan application. Present all the necessary documents required for the release of the loan proceeds.

~~~

This article on Title Registration is written by Carlos Velasco.

Hi Maam / Sir,

Im Mary Jane Gascon, I dont have any yet off a house thats way i am looking for it. I want to have a house in bacoor or molino. Can you please try to look for me, coz i dont have any of time to look for it…???

Thank you for your kind and consideration. Hope to hear you soon…

Respectfully your’s

Mary Jane Gascon

Good day! Will I be able to have my house construction loan if the lot I own where I want to build my dream house is not considered as a residential area ?

@Jelly:

Pag-IBIG Housing Loan is limited only to residential units.

@MaryJane:

Please consider getting a broker or agent to help you find a property.

hi admin..

inquire ko lng po.

may binebentang lot po sa amin.., 2,000 sq mtr. ask ko lng po, kasi sa land title naka classify as agricultural..way back 1970’s.. pwede ko po ba cyang maloan sa pag-ibig, lot purchase lng then may area po dun na patatayuan ko nlng ng bahay..thanks and hope to hear from u soon..

another question po.. other choices po ng home improvement ay MPL po diba? mas lesser po mga requirements, sa MPL po.. magkano po ang loanable amount na pwedeng igrant sakin? panu nga po magcompute nyan?

may in-assume po ako na binabayaran n property under HDMF, ako po ang ngbabayad ng monthly amortization s pag-ibig pero ang receipt po ay nk-pangalan p rin s registered borrower. ano po ang magandang i-execute n document as proof n ako talaga ang nagbabayad ng property? pwede ko po b iyon i-submit s pag-ibig para po may proof ako n ako talaga ang nagbabayad? pwede ko rin po ba gamitin iyon para kpag trinasfer n ang title ay s pangalan ko na? kc po ako rin ang ngbabayad n ng conversion costs.

Good day,I just want to ask if you are a pag -ibig member you are qualified for housing loan already?thank you

I have an existing housing loan in pag-ibig for a house and lot i got in molino bacoor from a real estate developer. The title has already been transferred under my name. Since title has been transferred i was able to refund for the retention fee via our real estate developer. But i was shocked when i received my check they deducted around 65k for the cost of transferring the title. This amount is almost half of the retention fee from Pagibig. Is this a justifiable amount? I only have the list of costs they spent but documents to support the costs were not attached like documentary stamp tax which is has the biggest chunk around 27k. Just want to get an idea before i call our developer and ask them the supporting documents. Thank!

@RamosR:

Please refer that one to your developer.

@Lezel:

No, it doesn’t always follow. You still have to undergo a pre-qualification process.

@cely:

It’s good that you are able to detect it early on. This could lead to a lot of problems later on. At the very least, you need either of these documents:

1. Deed of Sale with Assumption of Mortgage for

2. Deed of Transfer of Rights with Assumption of Obligation

Please coordinate with one with the Pag-IBIG Branch that has jurisdiction over the property.

@james:

Take note that Pag-IBIG will only grant loans on residential real estate.

As to the MPL Loan, you can use it for small home improvements only because the loan amount that will be granted is also small.

Dear Admin,

My husband is OFW. meron po kami lot sa subdivision at plano po namin mag-loan ng construction para sa bahay. possible po ba yun at how mich po ang below and maximun loan for OFW at anu po mga requirment if possible.

Hello!

May nagbebenta sa amin ng condo na 5 yrs. na nyang binabayaran under pag ibig. Ano po ang proper procedure para ma transfer sa amin yung name or mabayaran muna lahat ng registered borrower bago ma transfer?

At pwede po bang i cash if ever gusto naming bilhin? Paano ang procedure noon kc long term (25 yrs.) payment kinuha yung condo. thanks.

good pm..sir/mam my son just submit d requiremnts 4 d townhouse we wnt to buy 2 d seller..just finished inspection,,now we wnt 2 know f after 15 days,,r we going 2 pay 4 d capital gain tax,documenttion,,title transfer at once?,,how many days it will takes f we paid those?

thanks a lot!..hope 2 read ur reply soon!

Dear admin

OFW po ako at balak ko po sanang mag housing loan, sa ngayon po nag babayad po ang wife ko sa POEA para sa contribution ko at balak po naming mag loan pag uwi ko next month sabi po ng wife ko 5000 na lang po un kulang para mabayaran ko un 2years na contribution ano pong dapat kong gawin at ano po mga requirements if ever mag loan ako.

At ano pong mga procedure salamat po

Good am po. may nagaalok po sakin ng residential unit na mga 3 years na atang di nababayaran, ang sabi samin ng owner pde daw ilipat sa pangalan ko yung housing loan tapos ako na lang ang sasalo ng monthly nya, tapos babayaran ko nalang daw sya kahit installment sa mga ginastos nya dati.

tama po ba yun?

nakaraceive nadin po yung owner ng notification to foreclose the loan.

at sabi nya pa nga babayaran pa daw sya ng pagibig kung mclose n yung loan nya. which is nkakapagtaka kasi delinquent borrower sya.

gusto ko sana yung unit, pde po ba mlipat yun sa name ko tapos ako nlang ang mgbabyad kahit nung mga penalties nya, pero dapat ko padin b syang bayaran sa mga ginastos nya? hope you can answer these admin. thanks po!

May ngbebenta po sakin ng residential unit. takot lang po ako kasi sabi nya nkreceive na sya ng notice of foreclosure. sabi nya kung gusto ko daw saluhin yung bahay kasi sayang daw. ask ko lang po kapag nalipat ba sa kin yung title, ako ba mgbabyad ng utang nya sa Pag-ibig at may babayaran din po ba ako sa kanya dun sa mga ginastos nya sa bahay?

pano po process ng transfer of ownership sa mga delinquent borrowers?

may weblink po ba kayo n pde ko basahin sa internet.? thanks po.

Hi admin,

Just wanna ask on how can i transfer my housing loan to my sibling?

Is that possible and if yes, can I get another housing loan?

gusto ko po sana bumili ng bahay aat lupa mlapit samin,, ang problema po kasi ung lupa ay hindi pa nakapangalan duon sa ngbebenta, dhil binili lng dn nya ung lupa n un,. pero meron po xang hawak n deed od sale at hawak dn po niya ang titulo ng lupa,, kung bibilhin ko po ung bahay at lupa na yun ay mkakapaghousing loan po ba ako? pwede po bang gamitin ang deed of sale sa housing loan?

@Clarice:

The collateral should be the land title, which is clear. Please ask the seller to give you the land title if he is serious about selling the property.

@lai:

You have to sell the property to him/her.

@Jeffrey:

This one is very complicated. It’s possible to buy this one, but you have to make sure that it will not be very expensive on your end. Ask him about his selling price, and the loan balance. Once you agreed on that, then it’s time to go to Pag-IBIG for the details of the deal.

@arnold:

Here’s the housing loan process:

https://www.pagibigfinancing.com/articles/2010/the-pag-ibig-housing-loan-process/

And you have to complete first your 24 months contributions.

@jesusa:

YOu definitely have to pay for those things. How long it would take depends on how fast you can do it and how fast they Regiter of Deeds can process the title transfer. Normally, it should just take roughly 3 weeks.

@Sonn:

The procedure is already outlined above on this on article. Please take time to re-read it. And yes, you can pay it all in cash.

@Maricel:

Well, the loan amount depends on many factors. The maximum is 3M.

dear admin,

nakabili po ako ng bahay sa sta rosa laguna. bale nag loan po ako sa pag ibig. after a while i recieved a mail from pag ibig na for contract to sell na ung property.. that is because sa hnd ko daw nababayaran ung real property tax. nung tinanung ko nmn ung sa developer on the process palang ung land title to transfer to my name. kasi 3years daw un kasi on process ng pag ibig. pano nangyari un na magbabayad ako ng tax e hnd pa nakapangalan sa akin ung title at on process palang.. please help.

quiry lang po kung ano ang dapat naming gawin, kc dito sa amin sa Bantayan island walang mga land title ang lupa coz we are declared as timber land and only the tax declaration

@agot:

Sorry, but that kind of property can’t be used as collateral for a Pag-IBIG Housing Loan.

@David:

The developer should take care of the real property tax. Please let them explain this to you.

tanong kolang po sana kng pwede kng ipasok sa pa ibig ang binibintang bahay sa akin.5years na po akng member.gusto k po sa na ipalakad sa asawa k ung mga papel na kylangan kc nnd2 ako ngaun sa abroad.ang problema po kc hnde pakami kasal pwede po ba sxa mag ayos nang mga doccuments.kng my mga kylangan po pwede naman sxa mag ponta nang opicna namin para kuhanin ang mga kylangan na papel.pakisagut naman po salamat.

@James:

Yes, that’s possible. You may need to issue an SPA to authorize her to work on your behalf.

I just want to asked, can you provide me the list of all required document for housing loan? may house and lot akong bibilhin worth 2M gusto ko sana ipasok sa Pag-ibig, 5 years na akonn member, and would it be possible to askied the step by step procedure i know n meron naman kayo para di na nalilito mga applicant..

Hope to see your response soon.

Thanks and GOD Bless

@Jerry:

Here are the documents you need to prepare:

https://www.pagibigfinancing.com/articles/2010/pag-ibig-housing-loan-requirements/

Meron po akong housing loan at 4 years na po akong nag huhulog. gusto ko lang pong malaman kung nasa pag-ibig na po ba ang title ng lupa? nag inquire na rin po ako sa developer thru sms pero wala pong reply. iniisip ko po na baka wala ng paki alam yung developer dahil bayad na ng pag-ibig yung house and lot.

Salamat ng marami

@Ricardo:

If you have a housing loan from Pag-IBIG you can be assured that they are the rightful holder of the title. You need not worry about this.

sinabihan na poh aku ng pagibig na lakarin na un pag transfer ng title sa name ku and so I did. Pero pagdating sa BIR, I was assessed a capital gain tax. I understand that doc stamp tax and transfer tax is to be paid by me…pero ang capital gain tax? and alam ku capital gain tax is paid by the seller.How do I know if my developer paid the said tax on the year the loan was released 2009? please advise.thanks poh

Carol,

You are right. The seller would normally pay for it, especially here that you are dealing with a real estate developer. Please inquire from them.

Hi, ask ko lang…paano po process ng pag i fully pay ang Pag-ibig housing loan ko? …anu-ano pa ang mga babayaran namin para ma-kuha ang titulo? thanks in advance…

Hi Rommel,

Please request a computation of your balance from the branch. You may also want to read this article for some tips on how to go about it:

https://www.pagibigfinancing.com/articles/2011/long-term-mortgage-loan-how-to-retire-it-early-part-1-of-2/

Sir/Ma’am,

Good afternoon, gusto ko lang po malaman kung ilang days or buwan bago marelease yung land title after pong mabayaran yung full payment sa Pagibig at ano pong mga requirements yung needed?Thank you

Hi Nikki,

It depends on the process time. But 2 months should be very long already.

good day,i’m PAG IBIG/POP member also for almost 5 years.and i’m Planning for house Construction.But my problem is, i have only updated tax decl.mostly kasi dito sa lugar namin yung mga lupa walang title.(TCT)gusto ko sanang mag avail ng housing loan (contruction)through PAG-IBIG.i have 2.5m for starting the said project.but i need more budget just to finish the construction(para Continues ang Trabaho).i dont have any liabilities.it is possible to submit only the updated tax decl.even w/o T.C.T.?also it’s possible for me to grant for 2m loan?since i have monthly salary of 250k.i can produce other documents asap but not the T.C.T.building permit/plans are in process now.if they will not honor the tax decl. only can i use my other land title.para sya kung gamitin dun sa lupang pag tatayuan ng bahay?many thnks. best rgrds.

Allan,

The TCT is a collateral requirement. You can’t take a loan without it.

Hi admin,

Sir i would like to take this opportunity to thanks you for your full effort on answering our questions, so let me ask my personal questions regarding my inquiry about pag ibig loan, i form my questions in a numeric way and pls answer the best that you can. Thanks admin.

1. I work here in the us and recently purchase a condo, i know if you lump sum your membership contri you can be a full member of pag-ibig, what do you think my maximum loan that i could apply in pag ibig eventhough im a first time applicant?

2. Assuming that im going to loan in pag ibig is 1M and my monthly is 8k plus something payable for 30 years, what is your procedure when suddenly in 5years time im going to pay 500k then after 5 years another 500k, will that be allowed by pag ibig? is there a recomputation on my monthly amortization? what about the interest and penalty would that be fix?

Please admin help me on this one because i dont want to make a wrong decision on my investment, Please enlightened me on the recomputation of existing loan, any help will be highly appreciated. Thanks in advace

2.

Hi Kevin,

Some quick answers for you…

1. You can be a member of Pag-IBIG the moment you make your first contribution. But the minimum required payment to get a loan is 24 months and you have to

be active also for 24 months.

The loan amount has more to do with your capacity to pay than the number of years you are a member. You can take the maximum loan amount (now up to P 6M) if you qualify to take that much.

This link here offers a better explanation:

https://www.pagibigfinancing.com/articles/2011/how-your-income-and-contributions-affect-your-housing-loan-entitlement/

2. That is called pre-payment. That is definitely encourage by Pag-IBIG and there is no such thing as pre-payment penalty for your Pag-IBIG Home Loan.

The procedure is very simple. You simply go to the branch where you got the loan and then pay whatever you want. It would be wise also to request a computation of your balance first so you can have a better idea how much to pay.

Hi good day po. Received my NOA already from Pagibig. Next step na po sa BIR and RD for transfer of title. Unfortunately, I cannot process those right now due to work assignments. Was given only 90 days to complete the requirements. Help naman po. Is it safe to ask someone to do the paper works for you. Is authorization documents enough? Are there institutions that could assist busy people on this. Ito kasi ang hirap pag sa individual ka bumili. Ikaw mag-aasikaso sa lahat. Help po please. BTW, this is a very good site. Relieved to discover this one. Many thanks.

Basti,

Normally, real estate brokerage companies can help you with that one.

hi ask ko lng po,,pwede po bang pag ibig na mag pa transfer ng title?

Greetings!

Plan ko po sna magloan ng housing loan sa pagibig kaso ung title ng lupa ay hnd po namin hawak kundi ang pinsan ko po ung me hawak nun at nkapangalan pa kay auntie ko pero mana po ung lupa at bahay ng papa ko..ano po need ko gwin para maqualified na po akong magloan sa pagibig housing loan?hooping for your advise..thank you

Hi admin, nakita ko po sa reply nyo na 2 months is long enough time to release the title ng bahay after ma full settle, kami isang taon na wala pa din, pabalik balik na kami sa ofis nyo, ang huling sinabi e nawala daw ung ledger pati ung ibang papeles ng isang manager dyan, may bibili na ng bahay namin xerox lang hawak namin galing sa pag ibig, pati deed of sale na isang taon na namin hinihingi para ma transfer sa pangalan namin walang pirma, paano po naging two months kung ang may problema ay ang mismong pag ibig? di po namin alam kung saan kami mag cocomplain, maayos naman kaming nakikipag usap kaso ung mga palusot ng pag ibig e parang inaamin na walang sistema, sila nakakawala ng mga importanteng dokumento, paano po ba mareresolba? galing kami uli sa pag ibig nxt month na naman daw, at susubukan daw next month, parang wala nang mangyayari sa property namin, matagal ng bayad sa inyo, taon din pala aabutin para lang makuha titolo. sana po maresolbahan na ito, thanks.

HI admin,

My girlfriend and I would like to buy a residential lot. Is it possible to have the lot named to both of us?

Thank y0u