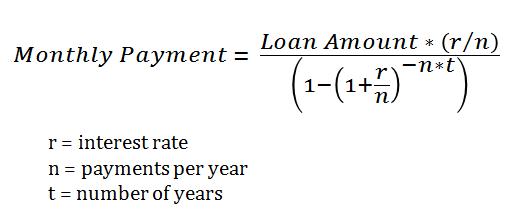

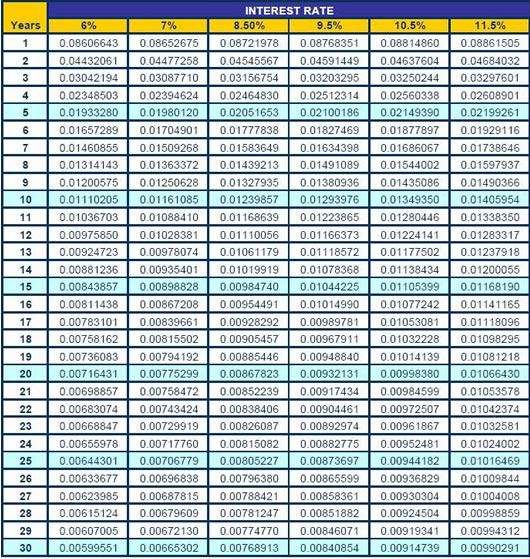

In the previous article about amortizations, you learned how to determine the monthly amortization given a particular loan amount, loan term (in years) and interest rate (per annum).

It is very important to bear in mind that these three factors primarily determine the scheduled amount of the monthly amortization.

This article somehow extends on the previous one and here I’ll discuss the following topics with the help of an online mortgage calculator, which is also included here:

- How to generate the Monthly Amortization Schedule.

- The two components that go into the monthly amortization: interest and principal dues.

- As the title of this article says, “How to save on your loan payments.”

The Mortgage Loan Calculator

With the help of the Mortgage Calculator shown below, let’s see how the amortization schedule looks like on a monthly basis.

Important Note When Using The Mortgage Calculator: When you click on the Calculate Button, the result displays in a pop-up window. To close the window, simply click the Close Button located at the upper right corner of the resulting pop-up window.

As you can see, the tool has some default values already and if those values perfectly match your loan, all you have to do is click on the Calculate Button to show the results. But for most of us, our cases are of course different from the default example.

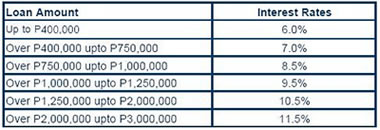

Let’s say your property costs P 2,000,000 and you are to put 20% down payment up-front — that should be P 400,000 out of your pocket. Furthermore, let’s say that the going interest rate in the market is 10.5% per annum and that you plan to pay the PhP 1,600,000 loan in 3 years only. From here, you want to determine the following:

- Monthly Amortization Amount

- Monthly Amortization Schedule

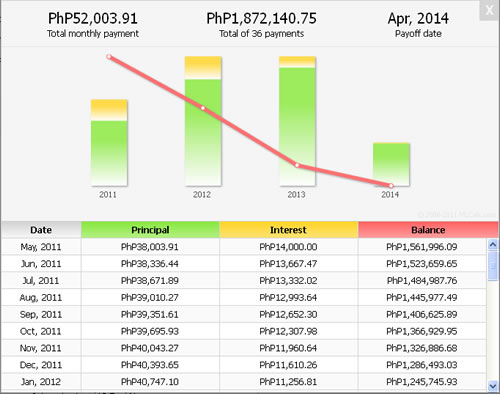

If you have entered the right values from the calculator shown above, you should get the monthly amortization at PhP 52,003.91 and that the total amount paid in interest for the whole 36-month duration of the loan should be PhP 272,140.75 (see at the bottom part of the resulting Amortization Table).

Here are some graphics to visually guide you on the results.

Figure 1 : Monthly Amortization Table for P 1.6M loan payable in 3 years at 10.5% interest rate.

The Amortization Table above only partially shows 9 months out of a total of 36 months amortization schedule.

You will find the total Principal and Interest Payments at the bottom of the Tabular data when you scroll it down. It should look like this on your screen:

Figure 2 : Monthly Amortization Table continued from the previous Table. This time, only the last part of the amortization schedule is being shown.

If your results don’t match with this one, please do it all over again until you get it right. This is a very powerful tool of analysis right at your disposal.

More On Interest and Principal Dues

Take another look at the resulting Amortization Schedule Table.

If you add up the Interest amount due and the Principal amount due at any row, it always results to 52,003.91.

That magic number is not at all magical. That’s your monthly amortization!

In other words, the amortization consists of two components, namely: the principal due and the interest due. Each payment that you make against your scheduled amortization, a portion of it goes to the principal payment and the other portion goes to the pay the interest.

From the example above, your first monthly payment of 52,003.91 pays for the PhP 14,000.00 interest and the PhP 38,003.91 principal. On the second month, PhP 13,667.47 is allocated for the interest payment and PhP 38,336.44 for the principal payment.

How To Save on Your Loan Payments

Have you noticed that at the early part of the schedule – that’s the first few rows of the tabular data – so much goes into the interest payment and only a small portion goes into the principal payment? And at the later stage of the schedule, a small amount is now allocated to the interest while the bigger part now goes to the principal.

(Actually, this will become more apparent at longer loan terms, say 15 or 30 years.)

This is always the case for mortgage loans: it follows the Declining Balance Model. That is, assuming your payments are religiously made on schedule, the principal balance is reduced over time and the next schedule is also smaller since the interest is always applied on the remaining balance.

So in other words, if you make a payment that is greater than the scheduled amount, the excess value is deducted from the principal, reducing the remaining balance further.

Actually there is a two-fold effect when you make advanced payments against your mortgage loan:

- you save on the interest payments

- you pay off your loan earlier

From here, we can say that one of the ways you can save on your loan payments is to make advanced payments. This way, you are actually save on paying the interests.

There are methods that help you determine the effects of advanced payments at any period of your amortization schedule, but we won’t discuss that in this article yet. Suffice it to say, that making advanced payments is almost always to your advantage.

~~~

This article on Mortgage Calculator and Amortization Schedule is written by Carlos Velasco.

I don’t how you feel after reading that one, but the first time I read it, I already felt sorry for the buyer. Of course, I read it for several times more making sure that I understood the real problem the letter sender is facing.

I don’t how you feel after reading that one, but the first time I read it, I already felt sorry for the buyer. Of course, I read it for several times more making sure that I understood the real problem the letter sender is facing.