There’s more to loans than just getting the money and paying for it. If you have been a frequent visitor to this website and you are constantly in the look out for new articles, you should already know that Pag-IBIG Loans (both Housing Loan and Multi-Purpose Loan) come with interests.

Borrowing Money Comes With A Price

No one in his “right mind” will take the risk of lending you money knowing that you won’t pay it back! Well, only friends and relatives do that. And I can’t tell you the number of horror stories I’ve heard related to that. Someone puts it best, “A fool and his money are soon parted.”

That’s why banks, non-profit foundations and other lending companies always impose interest on loans. Well, it will not be called a loan if it doesn’t come with an interest.

Going back to the topic, the interest actually serves as an incentive to the one loaning you the money. Think of it this way: When you borrow money from someone, you are actually using his money for your own purpose and the other guy is risking his money to you in the hope of getting a reward as an exchange. In this context, the interest serves as the reward, or incentive for lending you the money.

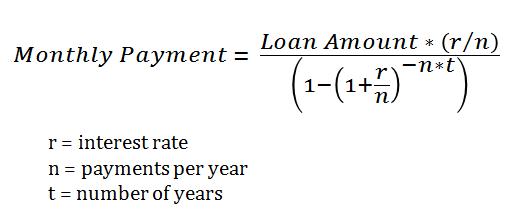

On the part of the borrower, the interest is also the cost of borrowing the money in the first place. And naturally, the cost of borrowing money is directly affected by three important factors: loan amount, loan term and interest rate.

After using the Mortgage Calculator presented here on this website, one visitor concluded as follows: “I see it’s better to buy a property in cash than finance through PAG-IBIG. The interest almost exceed the principal, you can even buy another house with that interest!”

After using the Mortgage Calculator presented here on this website, one visitor concluded as follows: “I see it’s better to buy a property in cash than finance through PAG-IBIG. The interest almost exceed the principal, you can even buy another house with that interest!”

He was right about his observation on the “interest almost exceed the principal“. But if such is the case, why would people still use a Mortgage Loan to finance their property investment? One answer is that, most people can’t afford to pay a house in a single Spot Cash payment.

(See also: Pag-IBIG Housing Loan 101.)

Housing Loan Interest Rates

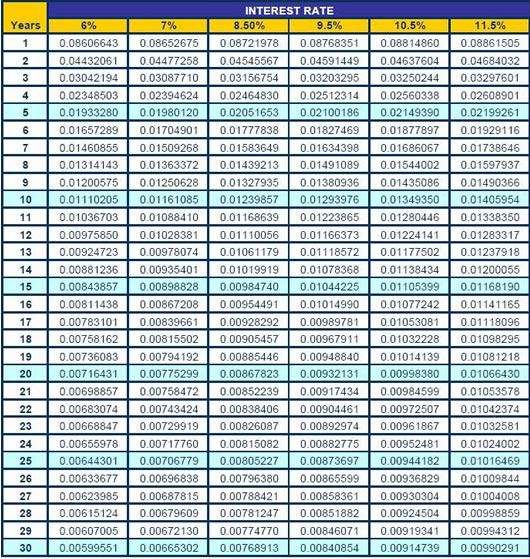

The Pag-IBIG Housing Loan Interest Rates have been presented here on this website for quite a while already. (As far as I can remember, way back when the site was still in its pre-launch stage.) You can find it at the Right Sidebar of this website, just directly above the Mortgage Calculator.

But for your convenience, and since we are already on this topic, we are presenting them below.

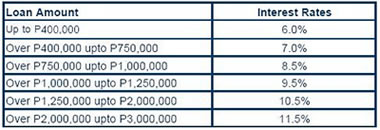

Housing Loan Interest Rates Table

| Loan Amt | Int. Rate |

| Up to P 400 k | 6% |

| Over P 400 k to P 750 k | 7% |

| Over P 750 k to P 1.0 M | 8.5% |

| Over P 1.0 M to P 1.25 M | 9.5% |

| Over P 1.25M to P 2.0 M | 10.5% |

| Over P 2.0 M to P 3.0 M | 11.5% |

From the table, it is clear that the interest rate for Pag-IBIG Housing Loan is 6% per annum for loan amount of up to P 400,000. And the maximum housing loan amount that you can get from Pag-IBIG is P 3 million with a corresponding interest rate of 11.5% per annum.

Note: The minimum amount that you can get from Pag-IBIG Housing Loan is PhP 100,000.

A reader of this website once dropped us a message: “Is the interest rate of Pag-IBIG Housing Loan fixed for the whole duration of the loan term?”

Good question and every Pag-IBIG Member who plans to avail of the Housing Loan should know about it.

The answer? That’s reserved for the next article of this series, plus the following will also be discussed:

- Housing Loan Defaults

- Pag-IBIG Multi-Purpose Loan Interest and Penalties

So stay in touch for the part 2 of this series and all the other articles we will be posting soon.

Update Notice: Part 2 has just been posted. Check out to learn more about Housing Loan Repricing, Defaults and Penalties for late payments.

~~~

This is the first part of a two-part series of articles on Pag-IBIG Loan Interest rates, penalties and defaults. This article is written by Carlos Velasco.